Ukraine-Russia Sanctions: Oil Embargo – Iran, Venezuela and Arab nations join Russia’s rally against the WestPosted 8March2022 TFIglobal ” Iran, Venezuela and Arab nations join Russia’s rally against the West “: Remember the long lines for Gas under President Jimmy Carter? |

|

Interesting Comments:

“Geopolitics for Dummies” – Chapter 2022, First edition. DemJoe + 6Chi (Demented uncle Joe and 6 Chihuahuas = G7) play a Poker game against a Bear and a Dragon. Chihuahuas have bad hands but are very keen on making big gains. Usually, the Bear and the Dragon do not bluff. If they have bad cards, they accept little humiliation and try to cut losses (See Chapters 2014-2021). A new round begins. The DemJoe is betting high followed by the 6Chi. This time the Bear plays tough but the Dragon remains calm. As the game progresses the Bear gets irritated by the barking Chihuahuas, shows some teeth and knocks on the neighbor’s door. Later, the Dragon is provoked by DemJoe to breath fire. Further, the game is intensified by exponentially rising stakes and this pushes the Bear and the Dragon to get closer. Suddenly, halfway through the game, DemJoe confuses everyone. He declares that they play game of chickens now, appearance is the most important and realities do not matter… Let see how the second half of Chapter 2022 will develop. One is clear, some Chihuahuas will get cold feet (no pun intended), innocent people will pay the price (as always), and puppeteers lurking in the dark will get filthy rich. (Disclosure – Editing of the chapter 2022 is greatly appreciated.) |

|

|

|

Nefesh B’Nefesh: Live the Dream US & CAN 1-866-4-ALIYAH | UK 020-8150-6690 or 0800-085-2105 | Israel 02-659-5800 https://www.nbn.org.il/ info@nbn.org.il It’s time to come home! Nefesh B’Nefesh: Live the Dream 1-866-4-ALIYAH |

|

Bolsonaro Asks WTO Not To Sever Russian Trade As 27 Fertilizer Ships Inboundby Tyler Durden 27April2022 – 01:00 AM https://www.zerohedge.com/geopolitical/bolsonaro-asks-wto-not-sever-russian-trade-27-fertilizer-ships-inbound The latest example of G-20 countries not bowing down to US pressure to halt trade relations with Russia comes from South America.

On Tuesday, in response to the World Trade Organization’s (WTO) Director-General Ngozi Okonjo-Iweala’s request for Brazil to increase more food exports, Brazilian President Jair Bolsonaro asked the WTO not to sever trade flows with Russia. He said there are 27 Russian vessels hauling fertilizer to Brazil.

Now, why would Bolsonaro go against the wishes of the US and EU politicians to eliminate trade with Russia?

Well, the South American country imports more than 85% of its fertilizer demand. Russia is its top supplier, and Belarus provides 28% of the total.

Restraining fertilizer consumption would be absolutely disastrous, crush harvest yields, and threaten the world’s food security. The country is a top exporter of coffee, sugar, soybeans, manioc, rice, maize, cotton, edible beans, and wheat.

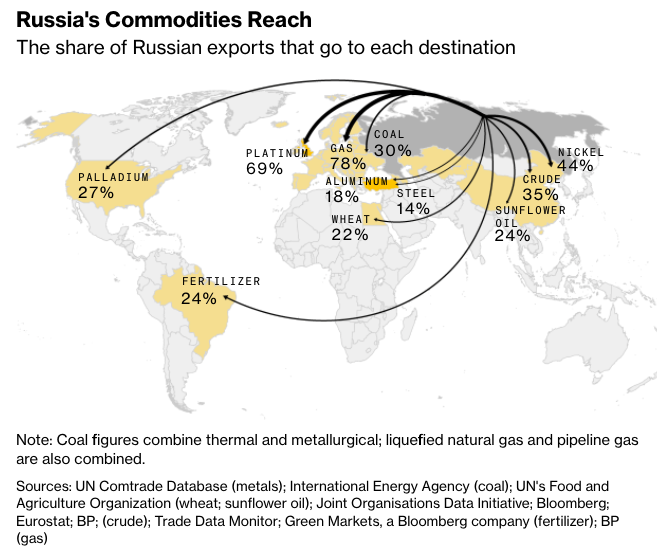

This is more evidence that G-20 countries, such as Brazil, India, and China, widely known as BRICs, disregard US pressure to halt trade with Russia. Many of these countries are dependent on Russia and Belarus for commodities. In one chart, here is Russia’s commodity reach: Defiant G-20 countries imply the old economic order, in which the dollar’s centrality to global trade remains king, is fading. Numerous countries are already trading outside the dollar system (see & here) because Western sanctions isolated Russian banks from the SWIFT payment system. This has given rise to commodity-based currencies.

It remains to be seen if South American traders will use a Brazilian real-Russian ruble payment system for the fertilizer purchases. |

|

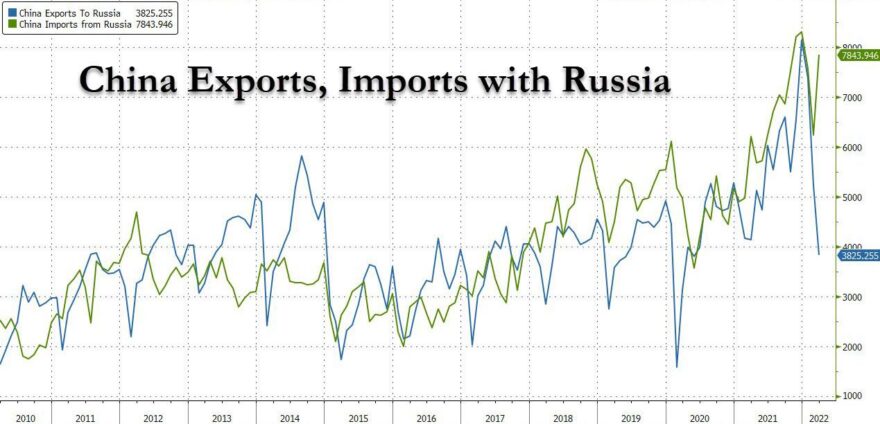

Chinese Oil Giant To Exit US, Canada And UK Over Fears Of Western Sanctionsby Tyler Durden 16April2022 – https://www.zerohedge.com/markets/chinese-oil-giant-exit-us-canada-and-uk-over-fears-western-sanctions An odd thing happened this week: for obvious reasons, Russian usage of the Chinese yuan has been booming in recent weeks, with the Nikkei reporting that Russia boosted yuan holdings over dollar just before the invasion (having previously dumped all of its Treasury holdings all the way back in 2018 telegraphing what was coming to anyone who was paying attention), and even though Chinese trade with Russia has soared…

… many Chinese companies had refused to side fully with Russia, amid concerns that they would be swept up in various secondary sanctions should the increasingly erratic Biden administration decide to lash out at Beijing.

That’s not the odd thing, in fact it is to be expected: after all, if you go after the king – in this case the king of global reserve currencies, the dollar, you better not miss and according to most experts, China is nowhere near ready to dethrone the US as the world’s biggest superpower (with or without the assistance of Russia). What was odd, is that Reuters reported that China’s top offshore oil and gas producer CNOOC, was preparing to exit its operations in Britain, Canada and the United States, because of concerns in Beijing the assets could become subject to Western sanctions, industry sources said.

In other words, one of China’s largest and most important companies has decided to pull the plug before it absolutely has to, in what appears to be a clear indication that what comes next will be very troubling.

The United States said last week China could face consequences if it helped Russia to evade Western sanctions that have included financial measures that restrict Russia’s access to foreign currency and make it complicated to process international payments. Additionally, the US has also made very clear that any Chinese invasion of Taiwan will result in an identical response to that faced by Russia now. The implication: one of those two things may be about to happen.

Some background: according to Reuters, while companies periodically carry out reviews of their portfolios, the exit being prepared would take place less than a decade after state-owned CNOOC entered the three countries via a $15 billion acquisition of Canada’s Nexen, a deal that transformed the Chinese champion into a leading global producer. The assets, which include stakes in major fields in the North Sea, the Gulf of Mexico and large Canadian oil sand projects, produce around 220,000 barrels of oil equivalent per day, Reuters calculations found.

However, it now appears that CNOOC has had enough, and last month, Reuters reported CNOOC had hired Bank of America to prepare for the sale of its North Sea assets, which include a stake in one of the basin’s largest fields. That’s just the start, however, and Reuters adds that CNOOC has launched a global portfolio review ahead of its planned public listing in the Shanghai stock exchange later this month that is aimed primarily at tapping alternative funding following the delisting of its U.S. shares last October. CNOOC is also taking advantage of a rally in oil and gas prices, driven by Russia’s invasion of Ukraine on Feb. 24, and hopes to attract buyers as Western countries seek to develop domestic production to substitute Russian energy.

As it exits the West, CNOOC is looking to acquire new assets in Latin America and Africa, and also wants to prioritize the development of large, new prospects in Brazil, Guyana and Uganda, the Reuters sources said.

Even before its exit, CNOOC faced hurdles operating in the United States in particular, such as security clearances required by Washington for its Chinese executives to enter the country.

And just to make it even clearer what’s coming, in its prospectus ahead of the initial public offering, CNOOC said it could face additional sanctions. “We cannot predict if the company or its affiliates and partners will be affected by U.S. sanctions in future, if policies change,” CNOOC said.

In the United States, CNOOC owns assets in the onshore Eagle Ford and Rockies shale basins as well as stakes in two large offshore fields in the Gulf of Mexico, Appomattox and Stampede. Its main Canadian assets oil sands projects are Long Lake and Hangingstone in Alberta Province.

All of the above is a very long-winded way to put what Rabobank’s Michael Every summarized in just a few words:

The answer? Because China will do things that will cause it to be subject to sanctions |

|

Israel Dumps The Dollar For China’s Renminbiby Tyler Durden Apr 22April2022 – https://www.zerohedge.com/markets/israel-dumps-dollar-chinas-renminbi Submitted by QTR’s Fringe Finance Over the last 48 hours, China and Russia have taken big steps toward separating themselves from the monetary policy and economies of the west – and nobody has even noticed.

Those who have been reading my blog for the last couple of weeks know that I have been predicting that China and Russia would grow far closer economically, creating, in essence, a second global monetary system where the US dollar is no longer the reserve currency.

A few weeks ago, I wrote an article proclaiming that Russia would back the ruble with gold as a way to fight back against western economic sanctions. I also made similar predictions about the new digital Chinese currency last summer when I first started Fringe Finance.

This shift is happening as a result of the United States and the rest of the western economies foolishly thinking that they’re going to be able to effectively sanction Russia economically, despite the fact that Russia is a massive producer of oil and the country seems prepared to back its currency, the ruble, with this productive capacity.

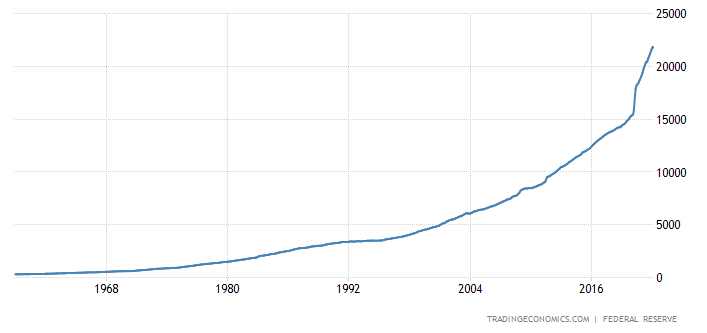

Meanwhile, back at the ranch, we continue to run enormous deficits and have very little productive capacity, and even less to back our currency with. Our destiny seems to be to continue printing money regardless of the negative consequences. We’re nothing more than printing press junkies that won’t cease our inflationary addiction until we inevitably hit rock bottom.

US M2 Money Supply (via TradingEconomics) If you haven’t read them yet, a couple articles that explain my position on Russia and China creating their own monetary system include:

Today’s post is not behind a paywall because I feel its contents are too important. If you enjoy my work, and have the means to support, I’d love to have you as a subscriber: Subscribe now There’s been several new developments to this thesis over the last 24 hours.

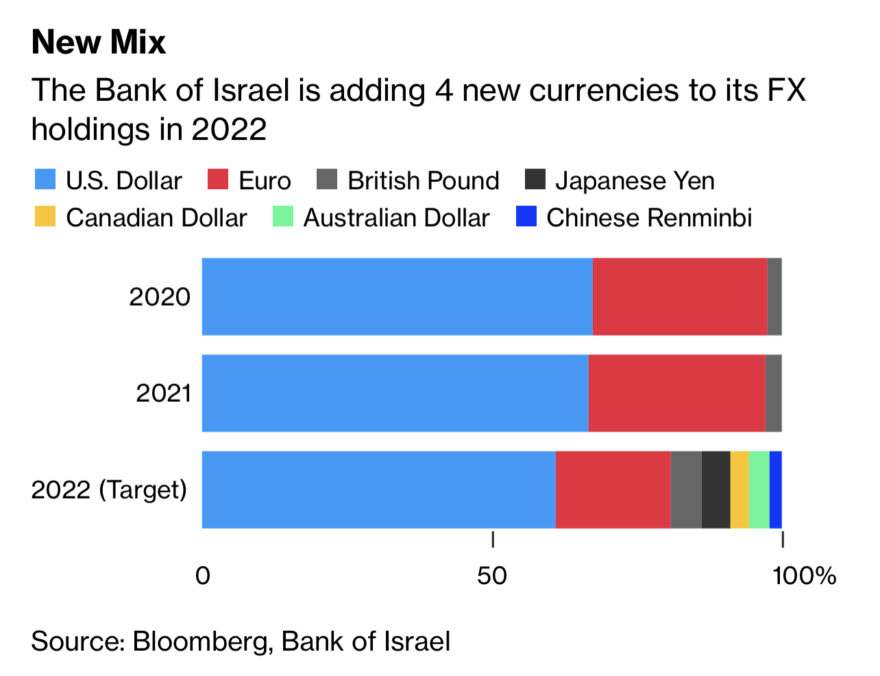

First, it was little noticed yesterday when Bloomberg reported that “Israel’s central bank has made the biggest changes to its allocation of reserves in over a decade, adding the Chinese yuan alongside three other currencies to a stockpile that last year exceeded $200 billion for the first time ever.”

The report read:

In other words, Israel is reducing its exposure to the dollar and to the Euro to add exposure to the Renminbi.

And so perhaps isn’t just little old me here chipping away at my blog daily that has noticed that China and Russia could be on the verge of effecting meaningful change to the global monetary landscape. It sure seems like Israel is catching on.

I expect other countries to follow suit.

Then, another prediction of mine started to come to fruition this morning when it was announced that China was considering buying some of Shell’s Russian LNG assets. Bloomberg reported:

I had previously argued on my podcast and on my blog that even though the west was going to be ignoring Russian investments, there would definitely be a strategic buyer who would come in and scoop up what can only be described as long-term strategic energy assets from Russia.

Many people smarter than I am, including macro analyst Luke Groman, predicted that China would be the strategic buyer for such transactions. I agreed.

Now, it looks like that is exactly what’s happening. These purchases will only serve to knit China and Russia’s economies even closer together.

If the picture hasn’t come into focus, it soon will – even for most people that aren’t paying attention yet.

China and Russia continue on a cooperative path together: doing business together, backing their currencies with tangible commodities and, as I wrote just days ago, we’re in the process of watching the dollar become dethroned as the global reserve currency. We just don’t notice it yet.

The next prediction I have, that hasn’t yet taken place, is that China will back its digital currency with gold. I’ve predicted this since August of 2021, long before the current macro picture has emerged. Now, my convictions are even stronger.

When the rest of the world catches on to what is playing out here, there’s going to be a mad dash for gold, in my opinion. I still prefer gold over any fiat currency and, as I wrote weeks ago, consider miners to be one of the market’s truly undervalued sectors.

Thank you for reading QTR’s Fringe Finance . This post is public so feel free to share it: Share |

|

JerusalemCats Comments: The Hatred for Israel by the Democrats is not new. Just look at their past Democratic National Conventions.At the Democratic National Convention 2016Protester burn Israeli flag outside DNC, Byron Tau/ Wall Street Journal Palestine sic flag at Democrat Convention, Social Media Protesters burn Israeli flags outside the DNC and DNC delegates wave Palestine sic flags inside the DNCThe long-time Jewish worship of the Democratic Party is based on the false premise, that U. S. President F.D. Roosevelt was pro-Jewish and saved the world by defeating the Nazis. He is also credited with ending the Great Depression, and that is another untruth.

Report: Netanyahu to Visit China, a Broadside to BidenBy David Israel – 8 Tammuz 5783 – June 27, 2023 Prime Minister Benjamin Netanyahu is no longer waiting for an invitation to the White House and plans instead to visit China next month, according to journalist Shalom Yerushalmi, reporting in Zman Israel. Advanced contacts are currently taking place between the office of the Prime Minister and the office of President Xi Jinping.

Yerushalmi cites senior Israeli political officials who told him that the extraordinary visit is intended to signal to Washington that Netanyahu has additional policy options, following President Joe Biden’s declaring him persona non grata in the White House.

“Netanyahu will not stand and wait for an invitation to visit the White House that never comes,” the source said, adding, “He works through parallel channels. China has been very involved in what’s happening in the Middle East lately, and the prime minister should be there and represent the Israeli interest.”

China has enormous economic investments in Israel. According to a December 2022 report on foreign investments issued by the Chief Economist at Israel’s Finance Ministry, China and Hong Kong are in third place in terms of the volume of incoming investments into Israel. In 2020, the total value of those transactions reached an estimated $26.5 billion. Among other prominent Chinese holdings in Israel is the Tnuva food production and marketing corporation which is among the top three or four vendors in the market, and the Haifa harbor, the largest free port in the Mediterranean basin, which is frequented by the US Navy’s Sixth Fleet.

China’s involvement in Israel has become so vast that the Biden administration is worried about protecting critical technology being developed by Israel and the US from the Chinese. The US sees China as the biggest geostrategic challenge it faces and wishes to restrict just how far Jerusalem can go in collaborating with Beijing.

Yerushalmi speculates that since last March, China mediated between Iran and Saudi Arabia to renew their diplomatic after a decade of hostilities between them, Netanyahu will try to promote Israel’s relations with Saudi Arabia through China’s influence, which would make Washington very unhappy.

Last week, Xi Jinping hosted PA Chairman Mahmoud Abbas in Beijing and presented a new Chinese plan for settling the Israeli-Palestinian dispute.

Officially, the Prime Minister’s office released the following statement: “Prime Minister Benjamin Netanyahu, today (Tuesday, 27 June 2023), at the Prime Minister’s Office in Jerusalem, met with members of the US House of Representatives and informed them that he has been invited to visit China.

The projected visit will be Prime Minister Netanyahu’s fourth visit to China; the American administration was updated one month ago.

Prime Minister Netanyahu stressed to the members of Congress that the security and intelligence cooperation between the US and Israel is at an all-time peak, and emphasized that the US will always be Israel’s most vital ally and irreplaceable ally.”

Netanyahu last visited Beijing in 2017, to mark the 25th anniversary of Israeli-Chinese diplomatic relations. He brought with him a large delegation of Israeli business people eager to do business with China. There’s no reason to think Israel’s hurting hi-tech executives won’t see the visit as an opportunity to infuse their industry with some yuans. On Tuesday, the value of 1 yuan is half a shekel (exactly the amount every Jew must pay for the upkeep of the holy Temple). |

|

The Allianceby Tyler Durden, 13August2023 – https://www.zerohedge.com/geopolitical/alliance Authored by Robert Gore via Straight Line Logic, Banging one’s head against the wall is not a wise strategy…

Russia and China head an alliance that poses the first direct challenge to the American empire since its inception at the end of World War II. Their strategy has been to follow Napoleon’s advice—not interrupting the U.S. government while it makes mistake after mistake—and to pursue the opposite of its hapless policies. Their power waxes; American power wanes.

August 29, 1949, the day the Soviets detonated their first atomic weapon, was the beginning of the end of the American empire. The U.S. government’s unrivaled power lasted four years and 23 days, from when it dropped an atomic bomb on Hiroshima. The Soviet bomb gave the world a counterweight to an American nuclear monopoly.

It is unclear if the Cold War was anything but a giant psyop on the part of the U.S. and the Soviet Union. By 1960 they had enough bombs between them to wipe out the planet, John F. Kennedy’s “missile gap” notwithstanding. This left a world where sane people believed that military conflicts had to be nonnuclear.

The U.S. became the national security, or warfare, state with which the nation is burdened today. In dollars and cents, it’s the second largest grift in history, surpassed only by the U.S. welfare state. The U.S. populace is always threatened by some megalomaniacal and evil power somewhere. Even conflict far from U.S. shores threatens the U.S. because of falling dominoes or because it’s better to fight them there than here.

Or because U.S. “interests” are at risk. This has become the go-to justification: “interests” are anything the war lobby says they are. The U.S. is fighting Russia via Ukraine to push NATO to Russia’s doorstep. Beyond the specious rhetoric of saving democracy and freedom in a police state riddled with neo-Nazis, it has to do with taking Ukraine’s natural and agricultural resources, hiding U.S. bioweapons labs, preventing disclosure of U.S. politicians’ links to Ukrainian corruption, and effecting regime change in Russia.

Someday there will be general recognition of Putin’s adroit conduct of the Ukraine-Russia war and the strategic masterstroke that is the Russia-China alliance. Losers on a roll require a hard, painful landing before they begin to wise up, if they wise up at all. The losers running the U.S. and its vassals are in for some hard, painful landings. When they look up from the gutter, drunks soaked in their own vomit, they’re going to see Putin and Xi Jinping, staring down at them with nothing but contempt.

It is well-earned. The U.S.’s annually spends three times what China and ten times what Russia spend and gets inferior weapons and a bloated, politically correct military. The waste of blood and treasure on imperial misadventures in Afghanistan, Iraq, Syria, Libya, and now Ukraine has been incalculable. Wasted treasure funds rampant corruption and has helped shove the U.S. into an abyss of debt. American self-confidence and justifiable pride in its history and culture have been thrown over in favor of nonsense. The U.S. government is the world’s most hated institution. If Ukraine doesn’t end its imperial misadventures Taiwan will, and there will no longer be an American empire.

Russia has mostly achieved its military objectives in Ukraine. Putin has been criticized for the slow grind, but Russia has annexed the Russian-speaking areas of eastern and southern Ukraine and secured land access and the water supply to Russian-speaking Crimea, already annexed. Russia has minimized its loss of life and destruction of weaponry and maximized Ukraine’s. An open question is whether Russian mounts an offensive against Odessa in southwestern Ukraine, completely cutting off its access to the Black Sea.

Ukraine’s president Zelensky talks of taking back captured territory. Such deluded bravado lends credence to the claims he’s a cocaine addict. Ukraine’s counteroffensive has been a dismal failure, floundering on Russia’s defensive strategy. Ukraine has seldom been able to advance past Russia’s buffer zones, much less penetrate its complex multi-layer defenses. Estimates vary, but casualty ratios of seven- to ten-to-one against Ukraine are probably in the right ball park. Men and machinery have been fed into a Russian meat grinder, leaving Ukraine woefully unprepared for a Russian counteroffensive should the Russians decide to mount one.

Ukraine has an estimated 300,000 to 350,000 killed, including the cream of its military. Millions of Ukrainians have fled the country, and Russia now controls most of its best farmland and mineral wealth. If it cuts off Black Sea access Ukraine will be a carcass state with little to offer to Western financial vultures.

Early on in the war Russia and Ukraine had a tentative peace deal, which the U.S. and Great Britain nixed. You only get one chance to accept a Russian deal, and then the offers get progressively worse. The nixed deal would have been far more favorable to Ukraine and NATO than the terms Russia will eventually impose. The meme-fodder picture of a forlorn Zelensky standing by himself at a NATO reception starkly illustrates that his “allies” are backing away.

Not only does a country that spends a tenth of what the US does have superior weaponry, it has superior production capabilities. Wagner PMC head Eugene Prigozhin’s complaints notwithstanding, the Russian military seems to have what it’s needed to decimate Ukraine. Meanwhile, arsenals are running low in the U.S. and Europe and they’re resorting to desperation weapons—cluster munitions and depleted uranium shells—which will render parts of Ukraine toxic for decades.

Just as humiliating for the West has been its economic sanctions. They were designed to devastate the ruble, stop foreign trade, and bring Russia’s economy to its knees. They’ve done none of the above and the Russian economy is growing.

Cutting off cheap Russian natural gas and replacing it with expensive American liquified natural gas hasn’t had a salutary effect on European economies. Western economic statistics are a division of Propaganda Central, but it appears that recession either looms or has arrived for much of Europe. Cheap Russian oil and natural gas isn’t coming back. If Seymour Hersh is to be believed, the U.S. blew up the European-Russian Nord Stream pipeline. Further proof of the old adage that you’re better off being America’s enemy than its friend.

For decades, America’s foreign policy doyens have counseled against doing anything that would bring Russia and China together. That wisdom is out the window. While international diplomacy has no matches made in heaven, the Russian-Chinese alliance is about as close as it gets. Marry Russian natural resources to the Chinese industrial machine and maintain joint control of what’s been considered the center of the world since Halford MacKinder’s seminal paper back in 1904, and you’ve got one of history’s most formidable alliances.

It is deftly incorporating much of the non-Western world, what Belarusian President Alexander Lukashenko calls the “Global Globe.” Trade arrangements, infrastructure financing and construction, and new transport, communications, and computer links are the face of an emerging, assertive multipolarity. Initially centered in Eurasia, this complex web of political and commercial agreements is extending to the Middle East, South America, and Africa.

The U.S. call for universal mobilization against Russia’s invasion of Ukraine was met with indifference outside the West. The Global Globe has grown weary of the U.S.’s rules-based international order, which amounts to acceptance of U.S. diktat . . . or else. The U.S. government follows or disregards its own rules at its convenience.

Not only are the Russians and Chinese offering better terms, but their carefully crafted rhetoric is that of partnerships, equality, and multipolarity. The American empire’s subjugation and hypocrisy are sandpaper on billions of open wounds. Only Americans are surprised by the seething resentment. It’s not going away anytime soon.

The alliance has another ace up its sleeve. The ideas that fiat emissions are money and that something can be had for nothing have left Western governments with mountains of debt and unfunded obligations that will never be paid. Debt has reached its hamster-wheel inflection point: more spending leads to more debt leads to higher interest costs leads to more spending.

Gold is money; everything else is credit, and fiat debt and currencies are barbarous relics. Shifting the Global Globe away from fiat towards gold is going to be a monumental task, but indications are that gold-rich Russia and China are undertaking it. If they eventually adopt a currency or currencies that can be freely exchanged for gold, the dollar’s days as the global reserve currency will be over. Good as gold beats barbarous fiat every time.

Feeble and corrupt Joe Biden is America’s nominal leader. His camarilla is made up of nonentities who would require substantial upgrades to hit either mediocre or amoral. The rest of the West’s so-called leadership is no better. This state of affairs must strike Putin and Xi Jinping as fortuitous. They have to worry about global reverberations of Western economic collapse and the possibility that Western leaders, desperate from their Ukrainian military failure, might take it nuclear. However, nothing is quite as satisfying as watching your adversaries checkmate themselves.

Russia and China are winning the global chess match. That’s not to say they’ll always win. Both governments are the usual top-down, repressive, organized crime that carries the seeds of its own destruction. However, the U.S. government is banging its head against a wall trying to impose its brand of imperialism on the two. Reality, the ultimate wall, always wins. Only after the tidal wave of consequences breaks will the U.S.—or parts of it—have a chance to recover.

Recovery will lie in the rediscovery of enduring truths. The game of thrones is a game of fools. A nation’s greatness is the liberty of its citizens to live their lives and pursue their happiness. The best foreign police is peace, commerce and honest friendship with all nations; entangling alliances with none. There’s no such thing as a free lunch. Anything the government gives you it took away from someone else. A government big enough to give you everything you want is a government big enough to take away everything that you have. Like fire, government is a dangerous servant and a fearful master. The more corrupt the state, the more numerous the laws. Power corrupts, and absolute power corrupts absolutely. A is A. |

|

Luongo: EU’s Oil Price Cap Is “Simply Moronic”, Chindia Already Filling Gapsby Tyler Durden, 10December2022 – 04:20 PM https://www.zerohedge.com/energy/luongo-eus-oil-price-cap-simply-moronic-chindia-already-filling-gaps Authored by Tom Luongo via Gold, Goats, ‘n Guns blog, The EU and the US went forward with their long-debated, long-telegraphed move to put a price cap on Russian oil at $60 per barrel.

By believing they can pressure suppliers into not hauling Russian oil lest they run afoul of the sanctions that support the price cap, they believe they can take only Russian oil off the market for the long run. Because of the way oil is actually traded in the real world, versus the way it trades in Janet Yellen’s head, this policy is actually much harder to implement than it actually looks. You don’t buy oil at the crude oil counter at Target or Wal-Mart.

There isn’t a price tag you can look at and say yes or no too. As Tsvetana Paraskova at Oilprice points out, crude contracts are written based on a discount or premium to a benchmark price at a particular moment in time.

To complicate things further, the EU wants to remain flexible to change the cap at its discretion.

If this sounds like a recipe for complete disaster, it is. No matter what happens here, the quantity of oil to be produced under this cap, even if it isn’t successful, will go down. Period. See chart below. If you disagree with this then you might just qualify to replace Yellen as Treasury Secretary of the US.

That said, Janet Yellen may be stupid, but she’s not that stupid. She knows what this price cap she’s championed will do. So, as always, with these people the question you shouldn’t be asking isn’t, “Will this work?” or “How will Russia respond?” but rather, “Is this the point of the exercise?”

I was contacted by Sputnik News for my comments on this (article here) and this is the tact I took in answering their questions.

If everyone involved knows that price floors and price ceilings always and without fail create production shortages, then why did they do this when the world clearly need more oil?

Because this is a feature of the policy, not a bug. By doing this, like every other intervention into oil delivery since the start of the war in Ukraine, the goal was to take Russia’s supply offline and hope that other producers would see the opportunity to take market share from the evil Russians while simultaneously trying to push capital investment into competing energy technologies — like nuclear, hydrogen and unicorn farts.

It hasn’t worked. Russia happily sells their oil at a major discount to Brent Crude, but will it remain the $30 China and India have been paying below Brent? Only if Brent stays at $90+ per barrel. With Brent now trading in the high $70’s those discounts will attenuate.

And with Vanguard following Blackrock’s lead in ditching ESG as a policy driver for investment flows, we’ve likely reached the limit of this stupidity, because despite the protestations of commies the world over, capital flows to where it is treated best.

That flow is now distinctly around Europe rather than the intended target, Russia.

There are many goals of this price cap, some stated, some implied, my comments are in italics afterwards.

I’ve maintained for years that Europe feels they have some kind of monopsony (single buyer) power over Russian energy. And all they have to do is hold their nose and refuse to buy Russia’s products and this will force them to sell to them at whatever price they demand.

What I’m still trying to figure out, however, is how much better a deal do they want than the one they had pre-Ukraine War, a war they did nothing substantial to stop?

To believe that the EU only pursued this antagonistic relationship with Russia because it is a colony of the US Empire is simply delusional at this point. At no point did Europe try to make peace with Russia financially, economically or diplomatically.

Former German Chancellor Angela Merkel reiterated recently in an interview with Die Zeit that the Minsk Accords were designed as a delaying tactic to arm Ukraine for the future war against Russia.

This admission blows up that entire coping narrative of ideological leftists who hate the US (and all that it supposedly still stands for, i.e. capitalism) so much they can’t accept the reality of their insanity.

Europe chose this path. They chose freely to freeze Russia’s foreign exchange reserves, decline to buy their oil and gas, and sanction Russia to the point of destabilizing not just their own food and energy security, but also everyone else’s in the process.

Davos hates the freedom that oil and gas represent. Their strategy is to starve the entire oil complex of needed capital and hope it collapses. What it’s doing is accelerating the creation of parallel markets for shipping, insurance, payment clearance and investment banking for base commodities in markets outside of their control.

They’ve interfered in elections/governments the world over in key pockets of resistance — the US, Brazil, now Peru, the UK, Pakistan, Kazakhstan, — to disrupt any further integration of Asia.

Most of these have failed, but have succeeded in making the world less safe, less predictable.

The price cap is a stupid policy implemented by people with a clear animus against humanity itself that they would drive the world to the brink of nuclear war. It’s nothing more than the same scorched earth policy that’s been on display for years now.

If we can’t rule the world, we will burn it down. All it’s really doing is accelerating the split between East and West. Russia is done with Europe. They have turned East and will wait for Europeans to come to their senses and find common ground. Both they and the Chinese realize now there is no return to normalcy without the West collapsing in a fit of rage.

All over a few miserable dollars per barrel. As always, my full replies to Sputnik are below the line. As the price cap on Russian oil comes into force, how will the global market react? What long-term consequences do you expect?The price cap is simply moronic from a price perspective. Any 1st semester student of economics understands that price caps/floors create shortages. So, we shouldn’t look at price directly. Price is a consequence of supply and demand, in this case a deliberate attempt to create a shortage by introducing unnecessary friction all throughout the oil supply chain to create a global shortage of energy.

Oil prices will rise in the short term because of this and investment in new oil sources will now accelerate but outside of the West who have turned completely hostile to new sources of oil entering the market. The price cap was conceived with the objective of punishing Russia over its special military operation in Ukraine – what are traps and pitfalls of energy supply politicization?As always with moves like this, there is the story we’re told and then there is the real story. This cap will not deter Russia in any significant way from exporting oil. What will happen is the map of oil delivery worldwide will change. Energy that flowed west will now flow east and south. The ESPO pipeline will see full utilization as demand from SE Asia rises.

Projects that previous to the divorce between Russia and the EU were uneconomic are now economic as a price floor has now been put on the market. That’s what is so funny about this ‘price cap’ on Russian oil, it’s actually a ‘price floor,’ ensuring that Russia, the country with the lowest cost per barrel of any major producer, has guaranteed minimum income going forward.

I believe the goal of Janet Yellen, the person most responsible for this idiocy, is to both raise the price of oil to accelerate investment into renewables but limit the amount of money Russia gets, starving them, and other oil producers of capital.

In short, it’s nothing new. These are the same people who put sanctions on Russia to make the ruble weak while the price of oil rose. How can the move backfire on G7 countries and the EU in particular?It already has. As I said, this is just an extension of the same policy that’s always been in place. What will (and is) happening is that the investment they are trying to retard into replacement oil and gas reserves will now occur outside of the western financial system and western currencies, i.e. the US dollar and the euro.

Capital flows both to where it’s needed and where it’s treated best. What’s happening in the West is one big policy to freeze capital where it is currently trapped and beat it with the ESG stick. I could write a book here about why this is dumb and counterproductive, but I’ll just state that, in short, it won’t work.

This price cap is the beginning of the major shift towards the East becoming the center for global capital investment. The price cap had sown discord within the EU and resulted in months of bickering – do you expect further split within the EU members now, as the measure came into force?Yes. But the European Commission isn’t listening and is continuing to play hardball with every EU member state and Russia on every issue. At the same time, they also support NATO expansion, which is tantamount to an open war declaration against Russia. Now it’s War Crimes Tribunals against Russia for a war it won’t fight or can even win.

The internal politics of gas delivery within the EU is now facing a shift with Italy’s Giorgia Meloni clearly angling to replace Germany as the port of entry for most piped gas into Europe. France and Germany are hopping mad about this.

This energy crisis in the EU is designed to break the spirit of Europe’s people to accept full totalitarian/centralized control over everything. The outward face of the EU is one of inevitability, while masking the deep divisions that are tearing it apart at the seams. What kind of problems will the EU face given that Russia’s Deputy Prime Minister Alexander Novak specified earlier that if the cap came into effect, Russia would either redirect its crude supply or slash production?China and India are already filling the gaps. Russian oil will be blended in the Bahamas or other storage ports and then sent back to EU refineries. It’s all shadow play and theater. The main goal, as I said, was to make the oil markets less efficient, raising costs while starving it of capital at the same time.

The EU will face continued high energy prices, a net outflow of capital from lack of investment and a falling currency as their competitiveness on the global market collapses. Considering that they are also an unreliable trade partner who constantly changes the terms of contracts while they are still active, will see trade that used to be done with it go somewhere else.

All they are doing is ensuring no one will want to do business with them after 2030, hence their full-throated support of further war with Russia over Ukraine…. If the EU will suffer, then so will the whole world. It’s the ultimate game of brinksmanship. And they are the ones driving this bus, along with certain old money connected players in the US, while simultaneously using those players in the US, like Yellen, as a smokescreen for their preferred outcomes.

The clear story now is that the EU is blaming the US for all of its ills, exactly like I said they would do over a year ago. EU Commission President Ursula Von der Leyen just did this, complaining about the US subsidies for green energy projects. French President Emmanuel Macron complained that the US was making too much money off selling the EU natural gas.

Are they serious? Putin offered them a way out of this but, as always, the Eurocrats want their cake and eat it too… they want to punish Putin and get their energy at subsidized rates. Seriously, why does anyone take these apparatchiks seriously?

Everything they do is the equivalent of pointing a gun to their head, pulling the trigger but only grazing the skull and then blaming everyone else for letting them do it and telling the Americans to go kick Russia out of Ukraine.

It’s pathological. What will be the market’s reaction in the event of Russia curbing its production?Clearly oil prices will rise. China and India will still buy Russian oil, refine it and sell it back to the EU at value-added prices. The money Europe used to make refining cheap Russian oil will now go to China and India, who paid for it at a discount, using their own currencies or rubles, and Europeans get stuck with the bill.

So, in 2023, expect another major wave of inflation based on rising energy prices, China re-opening its economy putting upward pressure on metals prices and food shortages from the EU’s war on the periodic table of elements. |

|

Whitney: A US-Led ‘Coalition Of The Willing’ Foreshadows The Splintering Of NATOby Tyler Durden, 19february2023 – https://www.zerohedge.com/geopolitical/whitney-us-led-coalition-willing-foreshadows-splintering-nato The destruction of the Nord Stream pipeline was a gangster act that reveals the cancer at the heart of the “rules-based order”.

How can there be peace and security when the world’s most powerful nation can destroy the critical infrastructure of other countries without deliberation or judicial proceedings? If Hersh’s report can be trusted—and I think it can—then we must assume that senior-level advisors in the Biden administration as well as the president himself deliberately perpetrated an act of industrial terrorism against a long-term friend and ally, Germany. What Biden’s involvement in the act implies, is that the United States now claims the right to arbitrarily decide which countries may engage in commerce with which others. And, if for some reason, the buying and selling of energy supplies conflicts with Washington’s broader geopolitical objectives, then the US believes it has the right to obliterate the infrastructure that makes such trade possible. Isn’t this the rationale that was used to justify the blowing up of Nord Stream?

Sy Hersh has done the world a service by exposing the perpetrators of the Nord Stream sabotage. His expose not only identifies the people involved but also infers that they should be held accountable for their actions. But while we don’t expect any thorough investigation in the near future, we do think the magnitude of the attack has been a “wake up” call for people who cling to the belief that the Unipolar model can produce morally-acceptable outcomes. What the incident shows is that unilateral action inevitably leads to criminal violence against the weak and defenseless. Biden’s covert operation hurt every man, woman and child in Europe. It’s a real tragedy. Here’s a quote from a recent interview with Hersh:

He’s right, isn’t he? The Biden administration has vastly miscalculated the impact these revelations will have on the public. The reputational damage alone is going to be immense, but they will also be used as the prism through which many critics see the war. In fact, there are signs that that may already be happening. On Sunday, Russian Foreign Minister Sergey Lavrov confirmed that the real objective of Washington’s war was not simply to “weaken” Russia and eventually splinter it into smaller pieces, but to force a split between Germany and Russia. Here’s what he said on Saturday:

Lavrov’s comments reinforce our own view that the conflict was concocted by Washington’s foreign policy experts who realized that German-Russo economic integration posed a serious threat to America’s dominant role in the global order. That is why Nord Stream became the primary target of US aggression, because the pipeline was the vital artery that connected the two continents and drew them closer together into an economic commons that would eventually become the world’s biggest free trade zone. This is what Washington feared most, and that is why Biden and Co. took such desperate steps to prevent the strengthening of economic relations between Germany and Russia. In short, Nord Stream had to be destroyed because Nord Stream marked the end of the unipolar world order.

Instead, of expanding on this belabored theory, let’s take a minute and see if we can figure out something about Hersh’s shadowy “source” of information. Allow me to frame it in the form of a question: Why did Sy Hersh’s source provide him with detailed, top-secret information about the Biden administration’s sabotage of the Nord Stream pipeline?

If you chose “d” then pat yourself on the back, because that is the right answer. No one in their-right-mind would take the risks that Hersh’s source took unless he felt the country was in grave danger. And, keep in mind, we might not even know what that what that danger is yet, since we don’t know what future escalations the neocons are planning. For example, it could be that US plans are already underway to deliver F-16s and long-range missile systems that will be used to strike deeper into Russian territory. It could be that the neocons want to detonate a nuclear device in Ukraine as part of a “false flag” operation. Or it could be that Biden plans to organize a ‘coalition of the willing’ (Uk, Poland, Romania) that will fight alongside US Special Forces in combat operations in east Ukraine. Any of these developments represent a serious escalation in the hostilities which would increase the probability of a direct clash with nuclear-armed Russia. In Joe Biden’s own words, “That’s what you call World War 3.”

He’s right, it would be WW3, which might explain why Hersh’s source summoned the courage to provide the author with the damning information about Nord Stream. He might have believed that the world was on the fasttrack to nuclear annihilation, so he risked his own life for ours. “No greater love hath any man…”.

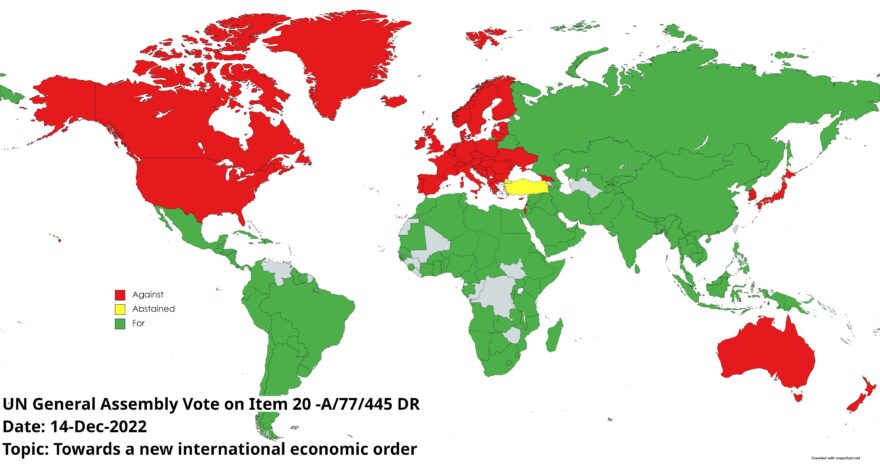

And the source is not the only person who put himself at risk. Hersh could face charges as well. In fact, I would argue, that if Hersh was not as widely-respected as he is, he would probably be sharing a cell with Julian Assange right now. After all, what is the difference between what Assange did and what Hersh did? Not much, except for the fact that Hersh’s stellar reputation makes him “untouchable. (We hope.)  The UN General Assembly adopts ‘Towards a New International Economic Order’ by a vote of 123-50 14-Dec-2022

In any event, if the motive behind the article was to prevent nuclear Armageddon, then we are very grateful for their bravery and selflessness.

Even so, there might have been other motives driving the article which are worth our consideration. Let’s imagine, for a minute, that Hersh’s source has information concerning the neocons plans for the near future. In other words, it is quite possible that the sabotage of Nord Stream alone was not the main impetus for Hersh’s report, but some other sinister plan on the horizon, that is, a military escalation that could trigger a catastrophe of unprecedented severity.

As we said earlier, such a plan might involve F-16s and long-range missile systems, or a nuclear “false flag” operation, or it could be that Biden will organize a ‘coalition of the willing’ that will fight alongside US Special Forces in combat operations in east Ukraine. US combat troops in Ukraine would make a direct clash with Russia effectively unavoidable. It would put the US on-track for another World War, which is what the neocons want. Unfortunately, I suspect that this is the most probable near-term scenario; the forming of a US-backed coalition organized to directly engage Russia in Ukraine. Here’s a “Statement from Press Secretary Karine Jean-Pierre on President Biden’s Travel to Poland:

As it says in the official statement, Biden will not merely talk to the Polish president about “collective efforts to support Ukraine”, but will also discuss US-Polish “bilateral cooperation as well”. But what type of bilateral cooperation does Biden want besides more weapons? Combat troops? Is that what Biden is looking for; coalition boots-on-the-ground to make up for Ukraine’s heavy casualties? Here’s an article from a website called Notes From Poland that announces a sharp uptick in Polish recruitment goals. Not surprisingly, the article does not explain the reason why Poland intends to more-than-double the size of its army within a year’s time.

Are we expected to dismiss this sudden expansion of the Polish military as a mere coincidence or is it more likely that a deal has already been made with Washington regarding future troop deployments to Ukraine? According to the White House statement, Biden will “also meet with the leaders of the Bucharest Nine (B9)” which is a group of nine NATO countries in Eastern Europe that became part of the US-led military alliance after the end of the Cold War…and includes Romania, Poland, Hungary, Bulgaria, the Czech Republic, Slovakia, and the three Baltic republics of Estonia, Latvia, and Lithuania. All nine countries were once closely associated with the now dissolved Soviet Union, but later chose the path of democracy. Romania, Poland, Hungary, and Bulgaria are former signatories of the now dissolved Warsaw Pact military alliance led by the Soviet Union…Check it out:

An army of Russophobes; is that what they want to create? It sure looks like it.

Maybe, we’re making a ‘mountain out of a molehill’; that’s certainly a possibility. But now that the Russian army is advancing on all fronts along the Line of Contact, we think that the desperate neocons are bound to do something colossal. In fact, we are sure of it. Check out this clip from an article at Larry Johnson’s web site, “The Son of a New American Revolution”:

Something is afoot although we cannot be certain whether it will materialize or not. But—keep in mind—there would be no need for terrorist attacks, false flags or additional combat troops if the official narrative was actually true and the Ukrainian army was winning the war. But that is not what’s happening. The Ukrainian Armed Forces are losing and losing badly. In fact, they don’t even have sufficient ammunition stockpiles to sustain long-term fighting. Here’s the story from Reuters:

How do you take a country to war with Russia without enough ammo to fight the enemy?

The incompetence is mind-boggling, and it’s not a short-term problem either. Western nations no longer have the industrial base to provide the necessary supplies and equipment for “large-scale, high-intensity warfare.” Building up capacity will take years. In the meantime, the war will be settled by well-equiped Russian combat troops who will continue to grind away at the demoralized Ukrainians who increasingly find themselves outmanned and outgunned at every turn. This is from an article at the UK Telegraph:

And this is from the New York Times:

And one more excerpt from the Paper of Record:

Get the picture? The war will undoubtedly drag on for some time, but the outcome is now certain. And as the noose tightens in the east and the prospects for success grow more remote, we think the neocons are bound to do something even more desperate, foolhardy and violent. We expect the next move will be an attempt to build a coalition of the willing (UK, Romania, Poland and US) that will push the reluctant NATO allies to the breaking point by pitting a makeshift US-led Army against Russia Forces on Ukraine’s killing fields. With every reckless action, Uncle Sam increases the probability of a critical split within NATO that will end Washington’s stranglehold on Europe and lay the groundwork for a new order. |

|

Has The Counter Revolution Arrived In The US?by Tyler Durden, 07December2022 – https://www.zerohedge.com/geopolitical/has-counter-revolution-arrived-us Authored by Tom Luongo via Gold, Goats, ‘n Guns blog,

There is no bigger heresy at this point in history than to suggest the US is not the main source of great evil in the world. There was a time, when the exact opposite was the case.

Today, however, As war rages in Ukraine and everyone in power in the West says they want peace but keep shoveling money and weapons into the conflict, the message is clear.

We want this war. We need this war and it doesn’t matter what the people want.

We will have this war.

But, here’s the big heresy, it’s not just the US that wants this war. Here’s another one is ‘The US’ as a global actor even exist anymore?

We are now digesting the most irresponsible escalation yet by “Ukraine,” a drone strike on a strategic airbase deep inside Russia attacking one leg of its nuclear triad — damaging strategic bombers capable of delivering nuclear warheads.

This is an explicit redline for Russia.

Regardless of what side of the line you stand on, Ukraine’s or Russia’s, in this war (or refuse to even define where the line is), this is a moment that should crystallize for you that this is a turning point in the war… and not for the better.

Escalations like this are a sign of weakness. They are tantamount to begging Russia to over-react, to force Putin’s hand and strike Ukraine mercilessly, which it seems they did in response.

Ukraine crossed the line where Russia would be free to use nuclear weapons per their use doctrine on attacking their nuclear deterrence capability.

Counterparts

The Berlin Wall and the end of the Soviet Union were fresh in our minds when RUSH recorded this deep cut off the album Roll the Bones. 1991 was supposed to be a time of hope, right? The Cold War was over. The free world triumphed over totalitarianism again.

A triumph of our system over theirs.

But at what cost? The US began the rapid rise into empire, eschewing the humble foreign policy directives of the Founders to expand NATO into the vacuum created by the end of the USSR. The European Union began its formalization into a political and economic behemoth, introducing the euro while its agents deep within the UK overthrew a rightfully obstinate Margaret Thatcher to bring the UK into the fold.

These western institutions were supposed to be the promise of a better life was supposedly for the former Warsaw Pact… well, except Serbia, but only Putin apologists talk about that.

The costs for the Cold War were obvious to everyone east of the Berlin Wall. But the costs for the West were equally substantial. To fight the Cold War the US was turned into a massive corporatist nightmare, the security state justified at every turn and our monetary system of hard money dismantled.

That counter revolution really was at the “counter of the store” as the US morphed from the country with the cleanest balance sheet in the world into the biggest debtor the world has ever, and likely, will ever see via a voracious consumer gorging on ever cheaper fiat money.

The free world was enslaved by its leaders’ arrogance and hubris and the people bought off with cheap money for disposable goods to mollify the anxiety and psychological damage done to two generations with living under the threat of nuclear war.

Now make that four generations thanks to “Ukraine.”

Then when the system broke in 2008 we papered over the sins of the banking system, went full retard ‘printer go brrrrrr’ and ushered in the truly irresponsible era of zero-bound interest rates, round-robin Central Bank coordinated balance sheet expansion which funded a massive security state through portable technology while selling it all as ‘hope and change’ for a world safe for trannies and pedophiles. Hold Yer Fire

We were supposed to be beyond the ‘dull gray world of ideology,’ but ideology is all we have left after having sold our souls for so little. As Alastair Crooke points out in his latest article, the West suffers from an ideological bias which precludes any other from being allowed to coexist on the planet.

This is where Putin and his Chinese counterpart Xi Jinping have practiced real heresy. They’ve said no to the Climate Change agenda of the West. But it goes far beyond that. They’ve said no to the entire western ideological framework of system over civilization.

Every argument made by European leaders like EU Commission President Ursula Von der Leyen is suffused with this ideological bias, this rightness of our system over any other.

And no escape route can be allowed. The EU is the one providing the ideological framework for continuing the war against Russia. The US is just cynically providing the weapons.

They are peas in the same aggressive collectivist pod. It’s why there is a 9th sanctions package on the way. It’s why they are forming War Crimes Tribunals in courts not recognized by Russia, and looking for legal means to steal all Russian assets within their geographical borders.

This is nothing more than wholesale looting that goes far beyond the initial violations of international law even the most hardened Ukraine supporter can accuse Russia of over the February 24th invasion.

This war should have been over in March but the UK didn’t want it to end and blew up the Ankara peace talks. Everything that has happened since then can then be laid at the West’s feet.

And I mean everything. The escalations have but one theme, take options away from Russia’s President Vladimir Putin until we get to the unthinkable moment.

For this defiance Putin is to be Milosevic’d for daring to say no to the EU and NATO for denying them control over Russia’s future and for embarrassing them by reminding the world of NATO’s involvement in the breakup of Yugoslavia.

And the worst part is that to say anything other than they are they are vassals to a crazed US government bent on global domination is, itself, heresy.

But is it really? By their words and deeds we shall know them.

Because the EU had many chances to stop this war but chose at every turn to double down. And now, they will deal with the flood of Ukrainians rightfully fleeing Russia’s now righteous indignation for keeping alive a war it didn’t want against people it considered brothers.

These escalations have a pattern. Ignore all of Russia’s security concerns and corner them into an invasion and use each move they make as justification for more aggression, until we’re now at the moment we’ve been groomed for for months, the decision by Putin to finally go nuclear.

So what’s really going on here? How did it come to this? Crooke reminds us of a 2013 speech by Xi on the subject.

The neocons and the Brits have tried to level this criticism at Putin, but that is clearly not the case. Putin, as any sober analyst will tell you, is the moderate in Russia. These crazed lunatics don’t want him deposed because they believe it will blow apart Russia, but rather they want Putin gone so that his replacement goes off half-cocked and nukes someone.

Because that is the only way to achieve their goals of having the war they need to reset their failing system.

Again, with these latest drone strikes from “Ukraine” that’s now on the table.

Putin is being ground into an untenable position, not by his own weakness but by the relentless ideological nihilism of western globalists who fear their own loss of power and need this war.

What else can you conclude as they pursue policies that can only result in the deaths of hundreds of millions of people? Vapor Trails

Their full support of Ukraine has reached its religious zenith with their oil price cap, which will cause further turmoil in a market that doesn’t need it. Davos’ puppet in Kiev, Zelenskyy, is now outlawing the orthodox church and openly threatening the hands that feed what’s left of his regime.

They tell us the ‘future of democracy’ hangs in the balance in “Ukraine,” a place where no democracy exists, apartheid-like laws are in place for ethnic Russians and is supported only by our tax dollars funding drone strikes on a nuclear power.

Who makes this case harder than Eurocrats like Von der Leyen?

To save democracy we have to abolish it. To save free speech we have to end disinformation.

Zelensky knows his time is short. Russia is making mincemeat of his country and this drone strike on the Engels airbase should be viewed as a last ditch effort to secure future NATO involvement. Open war between NATO and Russia is clearly the final goal of this attack.

With the follow up strikes on Russian oil tankers we’re rapidly reaching the point of no return.

The message is what it has always been: there can be no escape from the EU’s promised land of technocracy and the ideological nihilism of Davos.

That said, here’s the next bit of heresy. As bad as things are there are still forces alive who see where this is headed and are working diligently to keep Putin’s options open.

The attacks on Davos via the Fed’s aggressive rate hikes, Elon Musk’s buying Twitter and the smart game Giorgia Meloni plays in Italy are having their effect. I realize that all of these things are open to multiple interpretations and many believe I’m chasing smoke in a windstorm. But the incentives align here.

Remember, in geopolitics there are no allies, only interests.

Only the most ideologically nihilistic would pursue Davos’ path. Only those with a hatred of humanity born of a deep wellspring of love for all things Malthusian would bring us to this point. And to deny that there’s no one in a position to oppose this from our side of the new Berlin Wall is just surrender masquerading a cynicism.

To understand how fragile Davos really is I put it to you like this: For the price of a few hundred basis points, the Fed forced a coup in the UK, the ECB into a tightening cycle with more yield curve control, likely blew up FTX and its burgeoning offshore crypto-dollar Ponzi Scheme, and forced the Swiss National Bank to intervene against the bank run on Credit Suisse.

These are major weapons to have fired. Four major weapons. And none of those missile launchers can be reloaded. And all it did was buy the EU a few more months (weeks?) of undeserved euro strength.

Powell and company, on the other hand, have even more ammunition to tighten things further with the US 10-year trading at 3.5% now and US stocks going on a year-end rally. In fact, the SNB likely gave the Fed the biggest Christmas gift it could have by intervening in the Swiss Franc market to help Credit Suisse.

Davos’ Nuclear Triad of derivative control over commodity and currency markets, control over the US military through the “Biden” administration and narrative control through the media has been dealt a far bigger blow than “Ukraine” dealt to Russia’s supply of strategic bombers.

The war in Ukraine and the West’s over-the-top sanctions response crystallized the Global South against them. So, color me not shocked to hear no less than Saudi Arabia is coming to Credit Suisse’s rescue buying a major stake in its investment banking spin-off.

They’re giving Elon Musk the “Donald Trump treatment” for having the temerity to believe a free society rests on open communication. Musk’s moves since buying Twitter all point to the real goal of the exercise; buy the database of the Bluechecked Sneetches DMs and release the evidence of government pressure on Twitter to censor perfectly legal speech on every major Davos sanctioned operation against humanity.

We knew they were doing it but now we have something akin to proof that they were doing it. The initial response has been predictable — deny, screech, make fun, downplay and attack Musk and his agents like Matt Taibbi personally. But all that does is prove further they are caught red-handed.

The Davos response is always to double-down, it’s the psychopath’s way. They continue to act as if nothing matters, that they are untouchable. And they have to, it would be heretical to do otherwise as the entire fragile narrative edifice would collapse like a Jenga Tower made out of Styrofoam in a summer breeze.

These drone strikes inside Russia are to try and further weaken Putin, give spine to Russian hardliners and force things closer to the unthinkable.

And this is the real heresy here, the pressure coming from within the West is helping Putin execute his off-battlefield strategy of forcing monetary Armageddon on Russia’s enemies through control over commodity prices.

Putin’s on-battlefield strategy has been to drain Western coffers of munitions and warm bodies to fill increasingly cold trenches along the Dnieper River. I’m not saying that Putin is winning this war, but this is clearly the strategy being employed.

Has it empowered crazed neocons in Whitehall, the Pentagon and K-Street to think they can beat Russia once NATO officially gets involved in this conflict? Yes.

Is this a high-risk strategy at this point? Also yes. Could Putin have played this better? Absolutely.

But, this is the world we have now and the real heresy is not acknowledging everyone’s complicity in allowing it to get to this tragic state.

There’s a counter-revolution happening. The only question now is, will it mature in time to stop this train running on Davos’ time?

* * * |

|

Escobar: Geopolitical Tectonic Plates Shifting, Six Months On…by Tyler Durden, 25August2022 – 06:40 AM https://www.zerohedge.com/geopolitical/escobar-geopolitical-tectonic-plates-shifting-six-months Six months after the start of the Special Military Operation (SMO) by Russia in Ukraine, the geopolitical tectonic plates of the 21st century have been dislocated at astonishing speed and depth – with immense historical repercussions already at hand. To paraphrase T.S. Eliot, this is the way the (new) world begins, not with a whimper but a bang.

The vile assassination of Darya Dugina – de facto terrorism at the gates of Moscow – may have fatefully coincided with the six-month intersection point, but that won’t change the dynamics of the current, work-in-progress historical drive.

The FSB may have cracked the case in a little over 24 hours, designating the perpetrator as a neo-Nazi Azov operative instrumentalized by the SBU, itself a mere tool of the CIA/MI6 combo de facto ruling Kiev.

The Azov operative is just a patsy. The FSB will never reveal in public the intel it has amassed on those that issued the orders – and how they will be dealt with.

One Ilya Ponomaryov, an anti-Kremlin minor character granted Ukrainian citizenship, boasted he was in contact with the outfit that prepared the hit on the Dugin family. No one took him seriously.

What’s manifestly serious is how oligarchy-connected organized crime factions in Russia would have a motive to eliminate Dugin as a Christian Orthodox nationalist philosopher who, according to them, may have influenced the Kremlin’s pivot to Asia (he didn’t).

But most of all, these organized crime factions blamed Dugin for a concerted Kremlin offensive against the disproportional power of Jewish oligarchs in Russia. So these actors would have the motive and the local base/intel to mount such a coup.

If that’s the case that spells out a Mossad operation – in many aspects a more solid proposition than CIA/MI6. What’s certain is that the FSB will keep their cards very close to their chest – and retribution will be swift, precise and invisible.

The straw that broke the camel’s backInstead of delivering a serious blow to Russia in relation to the dynamics of the SMO, the assassination of Darya Dugina only exposed the perpetrators as tawdry operatives of a Moronic Murder Inc.

An IED cannot kill a philosopher – or his daughter. In an essential essay Dugin himself explained how the real war – Russia against the collective West led by the United States – is a war of ideas. And an existential war.

Dugin – correctly – defines the US as a “thalassocracy”, heir to “Britannia rules the waves”; yet now the geopolitical tectonic plates are spelling out a new order: The Return of the Heartland.

Putin himself first spelled it out at the Munich Security Conference in 2007. Xi Jinping started to make it happen when he launched the New Silk Roads in 2013. The Empire struck back with Maidan in 2014. Russia counter-attacked coming to the aid of Syria in 2015.

The Empire doubled down on Ukraine, with NATO weaponizing it non-stop for eight years. At the end of 2021, Moscow invited Washington for a serious dialogue on “indivisibility of security” in Europe. That was dismissed with a non-response response.

Moscow took no time to confirm a trifecta was in the works: an imminent Kiev blitzkrieg against Donbass; Ukraine flirting with acquiring nuclear weapons; and the work of US bioweapon labs. That was the straw that broke the New Silk Road camel’s back.

A consistent analysis of Putin’s public interventions these past few months reveals that the Kremlin – as well as Security Council Yoda Nikolai Patrushev – fully realize how the politico/media goons and shock troops of the collective West are dictated by the rulers of what Michael Hudson defines as the FIRE system (financialization, insurance, real estate), a de facto banking Mafia.

As a direct consequence, they also realize how collective West public opinion is absolutely clueless, Plato cave-style, of their total captivity by the FIRE rulers, who cannot possibly tolerate any alternative narrative.

So Putin, Patrushev, Medvedev will never presume that a senile teleprompter reader in the White House or a cokehead comedian in Kiev “rule” anything. The sinister Great Reset impersonator of a Bond villain, Klaus “Davos” Schwab, and his psychotic historian sidekick Yuval Harari at least spell out their “program”: global depopulation, with those that remain drugged to oblivion.

As the US rules global pop culture, it’s fitting to borrow from what Walter White/Heisenberg, an average American channeling his inner Scarface, states in Breaking Bad: “I’m in the Empire business”. And the Empire business is to exercise raw power – then maintained with ruthlessness by all means necessary.

Russia broke the spell. But Moscow’s strategy is way more sophisticated than leveling Kiev with hypersonic business cards, something that could have been done at any moment starting six months ago, in a flash.

What Moscow is doing is talking to virtually the whole Global South, bilaterally or to groups of actors, explaining how the world-system is changing right before our eyes, with the key actors of the future configured as BRI, SCO, EAEU, BRICS+, the Greater Eurasia Partnership.

And what we see is vast swathes of the Global South – or 85% of the world’s population – slowly but surely becoming ready to engage in expelling the FIRE Mafia from their national horizons, and ultimately taking them down: a long, tortuous battle that will imply multiple setbacks. The facts on the groundOn the ground in soon-to-be rump Ukraine, Khinzal hypersonic business cards – launched from Tu-22M3 bombers or Mig-31 interceptors – will continue to be distributed.

Piles of HIMARS will continue to be captured. TOS 1A Heavy Flamethrowers will keep sending invitations to the Gates of Hell. Crimean Air Defense will continue to intercept all sorts of small drones with IEDs attached: terrorism by local SBU cells, which will be eventually smashed.

Using essentially a phenomenal artillery barrage – cheap and mass-produced – Russia will annex the full, very valuable Donbass, in terms of land, natural resources and industrial power. And then on to Nikolaev, Odessa, and Kharkov.

Geoeconomically, Russia can afford to sell its oil with fat discounts to any Global South customer, not to mention strategic partners China and India. Cost of extraction reaches a maximum of $15 per barrel, with a national budget based on $40-45 for a barrel of Urals.

A new Russian benchmark is imminent, as well as oil in rubles following the wildly successful gas for rubles.

The assassination of Darya Dugina provoked endless speculation on the Kremlin and the Ministry of Defense finally breaking their discipline. That’s not going to happen. The advances along the enormous 1,800-mile front are relentless, highly systematic and inserted in a Greater Strategic Picture.

A key vector is whether Russia stands a chance of winning the information war with the collective West. That will never happen inside NATOstan – even as success after success is ramping up across the Global South.

As Glenn Diesen has masterfully demonstrated, in detail, in his latest book, Russophobia , the collective West is viscerally, almost genetically impervious to admitting any social, cultural, historical merits by Russia.

And that will extrapolate to the irrationality stratosphere, as the grinding down and de facto demilitarization of the imperial proxy army in Ukraine is driving the Empire’s handlers and its vassals literally nuts.

The Global South though should never lose sight of the “Empire business”. The Empire of Lies excels in producing chaos and plunder, always supported by extortion, bribery of comprador elites, assassinations, and all that supervised by the humongous FIRE financial might. Every trick in the Divide and Rule book – and especially outside of the book – should be expected, at any moment. Never underestimate a bitter, wounded, deeply humiliated Declining Empire.

So fasten your seat belts: that will be the tense dynamic all the way to the 2030s. But before that, all along the watchtower, get ready for the arrival of General Winter, as his riders are fast approaching, the wind will begin to howl, and Europe will be freezing in the dead of a dark night as the FIRE Mafia puff their cigars. |

|

From The Royal United Services Institute https://www.rusi.org/ A unique institution, founded in 1831 by the Duke of Wellington, RUSI embodies nearly two centuries of forward thinking, free discussion, and careful reflection on defence and security matters. The Return of Industrial WarfareAlex Vershinin 17 June 2022 https://www.rusi.org/explore-our-research/publications/commentary/return-industrial-warfare Can the West still provide the arsenal of democracy?The war in Ukraine has proven that the age of industrial warfare is still here. The massive consumption of equipment, vehicles and ammunition requires a large-scale industrial base for resupply – quantity still has a quality of its own. The mass scale combat has pitted 250,000 Ukrainian soldiers, together with 450,000 recently mobilised citizen soldiers against about 200,000 Russian and separatist troops. The effort to arm, feed and supply these armies is a monumental task. Ammunition resupply is particularly onerous. For Ukraine, compounding this task are Russian deep fires capabilities, which target Ukrainian military industry and transportation networks throughout the depth of the country. The Russian army has also suffered from Ukrainian cross-border attacks and acts of sabotage, but at a smaller scale. The rate of ammunition and equipment consumption in Ukraine can only be sustained by a large-scale industrial base.

This reality should be a concrete warning to Western countries, who have scaled down military industrial capacity and sacrificed scale and effectiveness for efficiency. This strategy relies on flawed assumptions about the future of war, and has been influenced by both the bureaucratic culture in Western governments and the legacy of low-intensity conflicts. Currently, the West may not have the industrial capacity to fight a large-scale war. If the US government is planning to once again become the arsenal of democracy, then the existing capabilities of the US military-industrial base and the core assumptions that have driven its development need to be re-examined.

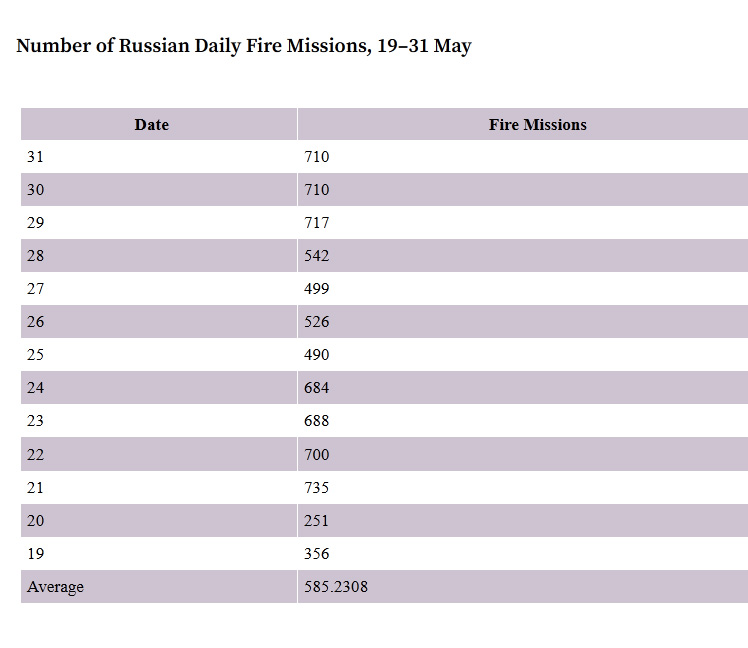

Estimating Ammo ConsumptionThere is no exact ammunition consumption data available for the Russia–Ukraine conflict. Neither government publishes data, but an estimate of Russian ammunition consumption can be calculated using the official fire missions data provided by the Russian Ministry of Defense during its daily briefing.

Number of Russian Daily Fire Missions, 19–31 May Although these numbers mix tactical rockets with conventional, hard-shell artillery, it is not unreasonable to assume that a third of these missions were fired by rocket troops because they form a third of a motorised rifle brigade’s artillery force, with two other battalions being tube artillery. This suggests 390 daily missions fired by tube artillery. Each tube artillery strike is conducted by a battery of six guns total. However, combat and maintenance breakdowns are likely to reduce this number to four. With four guns per battery and four rounds per gun, the tube artillery fires about 6,240 rounds per day. We can estimate an additional 15% wastage for rounds that were set on the ground but abandoned when the battery moved in a hurry, rounds destroyed by Ukrainian strikes on ammunition dumps, or rounds fired but not reported to higher command levels. This number comes up to 7,176 artillery rounds a day. It should be noted that the Russian Ministry of Defense only reports fire missions by forces of the Russian Federation. These do not include formations from the Donetsk and Luhansk separatist republics, which are treated as different countries. The numbers are not perfect, but even if they are off by 50%, it still does not change the overall logistics challenge.

The Capacity of the West’s Industrial BaseThe winner in a prolonged war between two near-peer powers is still based on which side has the strongest industrial base. A country must either have the manufacturing capacity to build massive quantities of ammunition or have other manufacturing industries that can be rapidly converted to ammunition production. Unfortunately, the West no longer seems to have either.

Presently, the US is decreasing its artillery ammunition stockpiles. In 2020, artillery ammunition purchases decreased by 36% to $425 million. In 2022, the plan is to reduce expenditure on 155mm artillery rounds to $174 million. This is equivalent to 75,357 M795 basic ‘dumb’ rounds for regular artillery, 1,400 XM1113 rounds for the M777, and 1,046 XM1113 rounds for Extended Round Artillery Cannons. Finally, there are $75 million dedicated for Excalibur precision-guided munitions that costs $176K per round, thus totaling 426 rounds. In short, US annual artillery production would at best only last for 10 days to two weeks of combat in Ukraine. If the initial estimate of Russian shells fired is over by 50%, it would only extend the artillery supplied for three weeks.

The US is not the only country facing this challenge. In a recent war game involving US, UK and French forces, UK forces exhausted national stockpiles of critical ammunition after eight days.