|

|

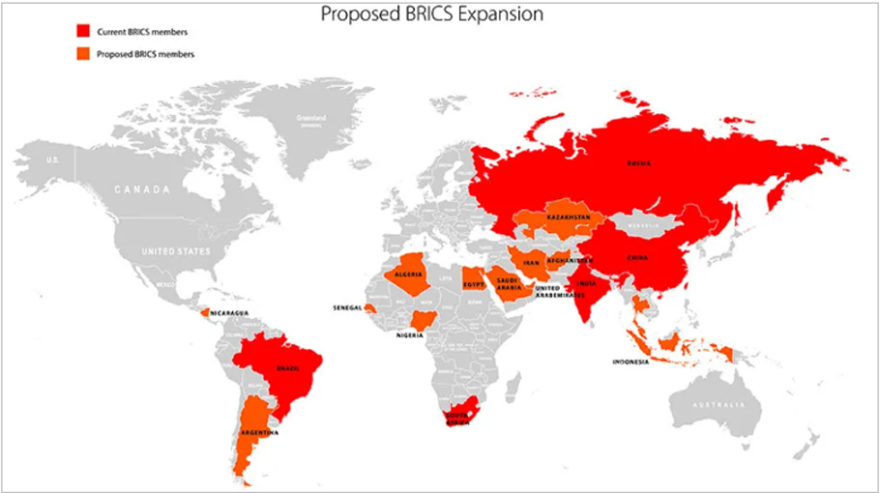

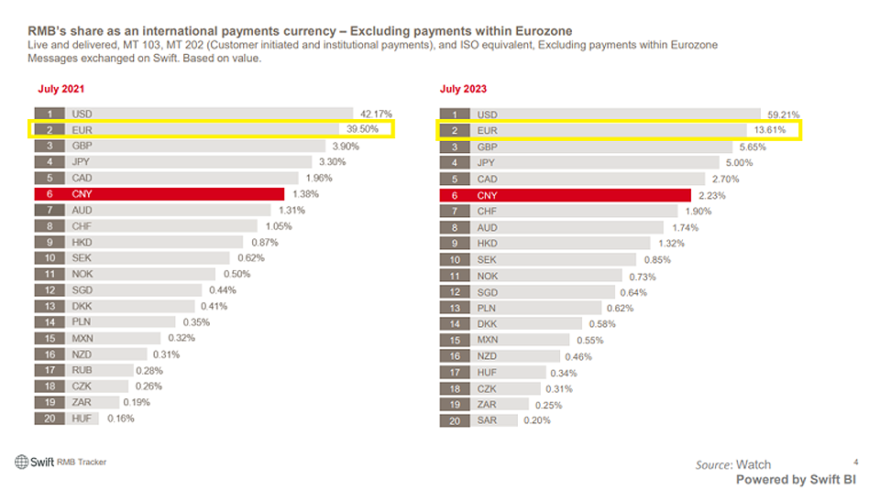

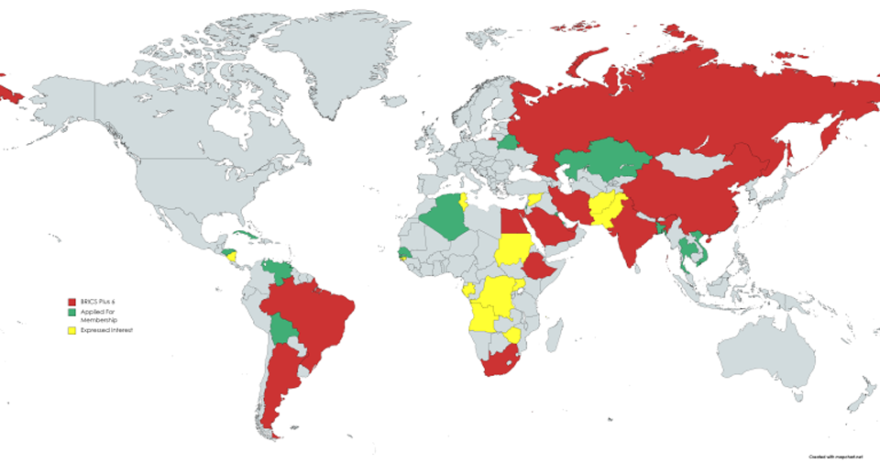

BRICSThe collective of Brazil, Russia, India, China, and South Africa is seeking to expand its ranks at the upcoming BRICS summit. Subsequently, with discussion over a developing currency to combat the US dollar, multi-polarization feels entirely within reach. BREAKING: Saudi Arabia, Argentina, Egypt, Ethiopia, Iran, and UAE to join BRICS on January 1st, 2024. What is BRICS and its Purpose?25September2023 https://watcher.guru/news/what-is-brics-and-its-purpose-2 What is BRICS and its Purpose? : Comprehensive Guide BRICS, an acronym for Brazil, Russia, India, China, and South Africa, is a group of major emerging economies that have come together to challenge the dominance of the United States and its Western allies in the global order. The bloc was founded in 2009 as an informal club to provide a platform for its members to assert their influence and promote economic cooperation. This article will explore the history, purpose, and key facts about BRICS, shedding light on its significance in the international arena. Also read: BRICS: The Beginning of the End for the US Dollar? Understanding BRICSBRICS is no formal multilateral organization like the United Nations or the World Bank. Instead, it functions as a forum for dialogue and collaboration among its member nations. The heads of state and government of the member countries convene annually, with each nation taking up a one-year rotating chairmanship of the group. The primary focus of BRICS is strengthening economic cooperation, increasing multilateral trade, and fostering development among its members. Also read: BRICS: UAE Navigating New Alliance & US Relations History of BRICSThe term BRIC was first coined in 2001 by Jim O’Neill, the then chief economist of Goldman Sachs, in a research paper that highlighted the growth potential of Brazil, Russia, India, and China. These four countries were identified as emerging economies with significant economic clout and the potential to reshape the global economic landscape. 2009 South Africa joined the group, and the acronym was expanded to BRICS. The Goldman Sachs BRIC ThesisThe concept of BRICS originated from the Goldman Sachs BRIC thesis, which asserted that these emerging economies would become significant global players. The thesis emphasized the rapid economic growth, large populations, and abundant natural resources of Brazil, Russia, India, and China. It predicted that these countries would outperform traditional Western powers regarding GDP growth and investment opportunities. Closure of Goldman’s BRICS FundDespite the initial optimism surrounding the BRIC thesis, Goldman Sachs closed its BRICS fund in 2015 due to the economic challenges some of the member countries face. This move raised questions about the sustainability and long-term viability of the BRICS concept. However, the group continued to exist as a forum for cooperation and collaboration among its member nations. What Countries are in BRICS?The founding members of BRICS are Brazil, Russia, India, and China. South Africa joined the group in 2010, expanding the acronym to BRICS. Together, these countries account for more than 40% of the world’s population and a quarter of the global economy. Despite its smaller economy and population, South Africa plays a vital role in representing Africa and strengthening the group. What is BRICS and its Purpose?What is the main function of BRICS?BRICS primarily serves as a platform for member nations to collaborate on economic, trade, and development matters. The bloc aims to foster mutually beneficial partnerships and reduce dependence on traditional Western powers. BRICS nations, united, can secure improved trade deals, foster investments, and tackle shared challenges effectively. BRICS Currency and Its PurposeOne of the key discussions within BRICS has been the possibility of establishing a common currency for the bloc. While this idea is still in the early stages of exploration, it holds the potential to enhance economic integration and facilitate trade among the member nations. A common currency could reduce transaction costs, minimize exchange rate volatility, and promote greater financial cooperation within the bloc. What is BRICS Currency Backed By?The concept of a BRICS currency raises questions about its backing and stability. We haven’t determined the specifics of a potential BRICS currency, but it would likely rely on member nations’ economic strength and stability. The backing could include a combination of foreign reserves, gold reserves, and the overall economic performance of the bloc. Also read: BRICS Currency a Driving Factor for Membership Interest Potential Expansion of BRICSBRICS has attracted interest from several countries seeking to join the group. More than 40 nations, like Iran, Saudi Arabia, and Indonesia, aspire to join the bloc. These nations see BRICS as an alternative to Western-dominated global organizations, aiming for benefits like development finance and trade. The Bottom Line: What is BRICS and its Purpose?In conclusion, the BRICS, comprising Brazil, Russia, India, China, and South Africa, is an influential group of major emerging economies aiming to challenge traditional Western powers’ dominance in the global order. While it is not a formal multilateral organization, BRICS serves as a platform for dialogue and cooperation among its members. The bloc primarily focuses on economic cooperation, trade, and development. As the world continues to evolve, BRICS holds the potential to reshape the global economic landscape and foster a more balanced and inclusive international order.

|

|

BRICS Officially Agrees To End Use Of US DollarVinod Dsouza

The BRICS alliance has called for the abandonment of the US dollar for international trade at the summit in Johannesburg. BRICS will officially end reliance on the US dollar for global trade settlements moving forward. South Africa’s President Cyril Ramaphosa confirmed that the bloc collectively decided to abandon the US dollar with no opposition.

BRICS will now continue promoting their respective local currencies for cross-border settlements and strengthening their native economies. The move will pave the way for a paradigm shift in the global economy and reshape the political landscape. Bilateral ties with other countries will be reworked, and the US dollar will face stiff competition in the long run. Also Read: BRICS: Is Chinese Yuan a Growing Threat to the U.S. Dollar?

BRICS Steps Away From The US DollarThe BRICS bloc announced that it wants to end dependency on the US dollar to promote their local currencies. The dollar’s debt factor also played a role in abandoning the USD. We will increase “payment options and reduce our vulnerability,” holding the dollar as reserves, said Brazil’s President Lula da Silva. Also Read: BRICS: China Targets U.S., Says America Is Obsessed With Hegemony BRICS will also convince other developing countries to trade in local currencies and not the US dollar. The greenback will slowly fade away from the international stage, making the debt ceiling crisis in America worsen. Read here to learn about the 10 financial sectors that will be impacted if the US dollar is no longer used for global trade.

Watcher.Guru-tweet-24August2023-Saudi Arabia, Argentina, Egypt, Ethiopia, Iran, and UAE to join BRICS Also Read: BRICS Developing Effective Mechanisms for Global Financial Control In addition, six new countries will join BRICS, further strengthening the alliance. Saudi Arabia, the United Arab Emirates, Argentina, Egypt, Ethiopia, and Iran will be members of the bloc. Five of the six countries are oil-producing nations and could change the way the world trades in the coming years.

In conclusion, the US dollar is in a ‘do or die‘ situation after the BRICS called to stop trading in the USD. The dollar could be on the path of decline if the ideas of the BRICS play out as planned.

|

|

BRICS Nations Buy Massive Amounts of Gold to Back the New Currency10July2023 https://watcher.guru/news/brics-nations-buy-gold-to-back-new-currency he BRICS alliance plans to launch a new currency backed by gold, reported RT News a month ahead of the summit. Russia has reportedly briefed the bloc on the importance of pegging the soon-to-be-released currency to gold. The move could make it easier to take on the U.S. dollar and challenge its global reserve status. The next BRICS summit will be held in South Africa in August and the formation of a new currency will be laid out. Also Read: BRICS: India Saves $7 Billion by Ditching U.S. Dollar For Oil Trade BRICS to Back The New Currency With GoldThe yet-to-be-launched BRICS currency could be backed by gold and the bloc of five nations are stockpiling the precious metal. In the last 18 months, the BRICS nations have increased their gold buying expenditure to end reliance on the U.S. dollar. Also Read: 6 New Countries To Join BRICS Alliance in August Summit The World Gold Council published a report saying that China purchased 102 tonnes of gold. Russia has purchased 31.1 tonnes of precious metal in the last six months. In addition, India added 2.8 tonnes to its gold reserves in 2023, for the first time in more than a year. India accumulated gold for several months and could add more by the end of the year.

The move puts the U.S. dollar in jeopardy as gold could be used as collateral and not the USD. The BRICS alliance could rely more on gold and completely end reliance on the U.S. dollar. If many more countries join the bloc, the new BRICS currency could be the preferred choice for cross-border transactions. Also Read: BRICS: 130 Countries Move Towards CBDC Currency, US Dollar in Jeopardy Gold is considered a safe investment and has a slim chance of collapsing than the U.S. dollar. The greenback is now a risky asset as it comes with the dangers of debt. If the debt ceiling crisis worsens, it could cause a domino effect of financial problems in developing countries. Therefore, a handful of countries in Asia, Africa, Latin America, and Europe, are looking to stay away from the U.S. dollar for global settlements.

|

|

BRICS Could Potentially Become Global CurrencyVinod Dsouza The BRICS alliance will launch a new currency in the next summit in August 2023 held in Cape Town, South Africa. The five blocs of nations Brazil, Russia, India, China, and South Africa will combinedly decide the formation of the currency. The yet-to-be-released tender will be pushed into the global stage to settle cross-border transactions among like-minded nations. The goal is to end reliance on the U.S. dollar and usher in a new era in the financial sector.

Even before its launch, around 41 countries have expressed interest to join BRICS and accept the currency. While 19 countries have formally sent applications to join BRICS, the others have informally expressed desires to enter the bloc. South African BRICS ambassador Anil Sooklal confirmed that the alliance could soon expand becoming BRICS+. Also Read: Europe Might Get Ready To Accept BRICS Currency BRICS Currency Could Go Global, Dethrone the U.S. DollarLeading economist Alexis Habiyaremye from the University of Johannesburg said that the BRICS currency could dethrone the U.S. dollar. The economist said that the U.S. dollar added a burden to the economies of developing countries through debt accumulation. The U.S. pressing sanctions aggravated the situation making their local economies come to a standstill. Also Read: Saudi Arabia To Challenge U.S. Dollar’s Supremacy by Funding BRICS Alliance Things could get better with the launch of the currency as the U.S. will have no control over their economies. If the BRICS currency gains widespread acceptance, the U.S. dollar will lose supply and demand on the global stage. The development could make the new tender acceptable and countries could sideline the USD in the coming years.

“In terms of economic weight, The BRICS currency has a real prospect of becoming a global currency if members commit to increasing trade exchange between themselves,” he said. The economist added, “Introducing a new currency if it were to be used effectively and systematically for all trade transactions between BRICS countries, would alleviate the burden on these countries to finance the exorbitant privilege.”

|

|

How BRICS Eliminated US Influence in the Global SouthJoshua Ramos

The past few months have seen the economic bloc continue to grow and establish a new global power balance. Subsequently, through a myriad of factors, it is undeniable that BRICS has all but eliminated US influence in the global south. A development that has opened the door to the undeniable growth of the alliance.

Yet, the elimination of American influence was not solely a victory for the BRICS collective. Alternatively, it was the development of decades worth of resentment toward the ideals of the United States. More importantly, it was the culmination of the status quo that has long affected the region negatively. The BRICS MovementIn recent statements, South African Ambassador Anil Sooklal discussed the state of the BRICS bloc. Specifically, addressing opposition to the collective. Interestingly, he stated, “BRICS is not a group of countries that is in opposition to any particular grouping.”

Additionally, Sooklal told Newsweek about the group’s desire. Noting the bloc’s hope “of reforming the global governance architecture, to make it more inclusive, more equitable, and more just and fair, which many of us continue to feel that it’s not.”

That sentiment is what has driven the expected growth of the BRICS bloc over the last several months. Indeed, it is what has driven more than 20 countries to submit their membership requests to join the bloc ahead of its annual summit. Subsequently, the opposite of ideology is how BRICS has all but eliminated the US influence on the global south.

“We see an erosion of the global multilateral architecture,” Sooklal added. “Unilateral measures, unilateral sanctions becoming the norm of the day, an uneven global architecture, and countries wanting to have a greater say in terms of how the new evolving global order pans out.”

Conclusively, Sooklal noted these factors as attracting “countries from the global south who increasingly want to identify with the BRICS group.” Additionally, noting, “the attractiveness of BRIS is that it articulates the challenges that countries from the Global South continue to face in a very unequal world. A world that vastly changed over the last 80 years since the founding of the U.N. System.”

Alternatively, the Secretary General of the India-China Economic and Cultural Council, Mohammed Aqib, adds another interesting aspect. Specifically, he told Newsweek that it is less about the potential that makes the bloc attractive. Instead, it is an ultimate goal.

“It is the quest for multilateralism stand breaking the hegemony of the West which is driving countries to join BRICS.” The US RoleIndeed, the growth of BRICS and the elimination of US influence on the Global South are byproducts of efforts from countries like Russia, India, and China. However, it is also a byproduct of decades worth of actions taken by the United States.

Amid the battle for international influence, Saqib stated that “the USA is turning BRICS into a geopolitical tool to contain China, coercing, coaxing, and threatening countries to somehow fail BRICS.” Subsequently, this perspective has driven the growth of the BRICS. As many have observed its potential, they have first observed what its potential means for Western dominance.

That kind of perspective only grew with the Western sanctions placed on Russia. Specifically, this set out to once again weaponize the global finance sector. It saw the United States and its allies tell countries who they could do business with, by limiting access to the currency they controlled.

Thus, the quest for greater de-dollarization took hold. Saqib noted, “De-dollarization will save countries from currency terrorism or sanctions and also offer fair terms of trade and influence of the West.”

Interestingly, these actions are an effort to create a multipolar order. Moreover, they have created an opportunity for nations that have long felt under the heel of the West, to stand shoulder to shoulder. This quest for an equal playing field is led by the actions of Russia and China, driven by the US itself.

The upcoming BRICS summit will surely allow discussion of potential expansion and an alternative currency. It will feature more than 20 nations discussing their potential entry. And it will be another indication that the BRICS countries have driven US influence from the global south entirely. Yet, the US certainly has a part to play in that.

|

|

BRICS New Development Bank Now Offers Loans in Local Currencies Instead of US DollarVignesh Karunanidhi

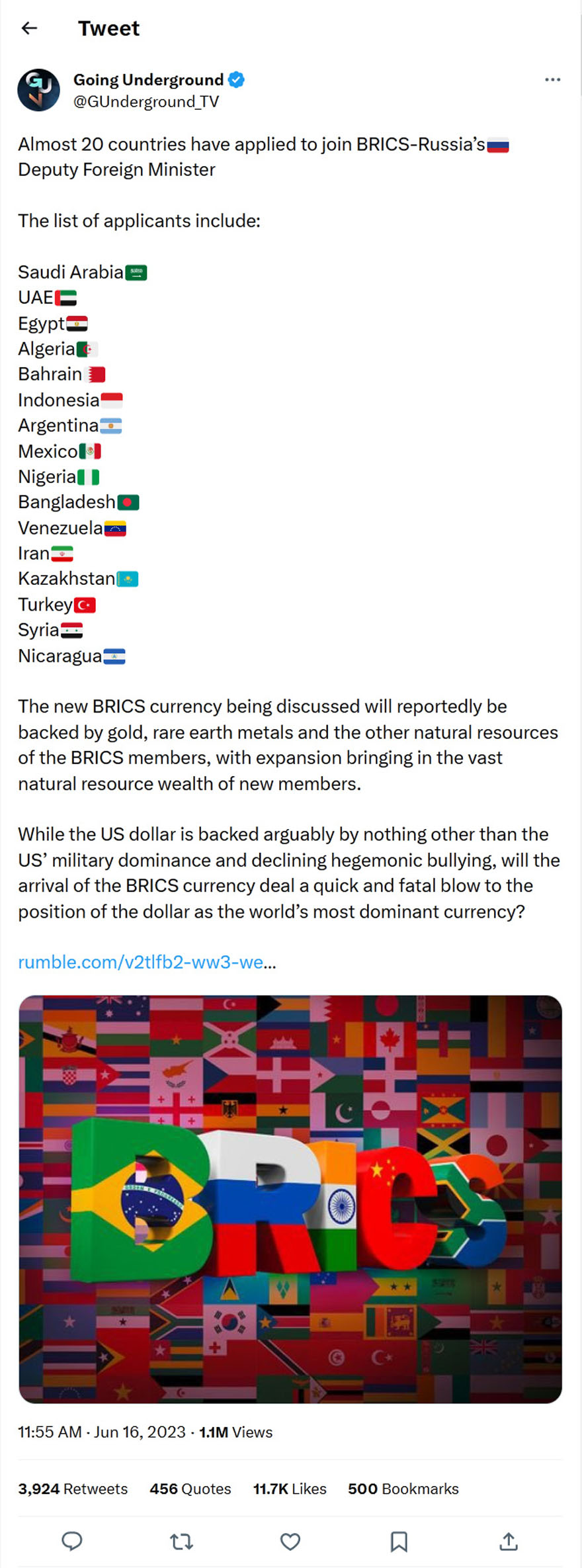

The US dollar has been losing its role in global trade. When the pound sterling lost its value during WWI and WWII, the US dollar was established as a global reserve currency. However, global nations are slowly steering away from US dollar reliance.

Now The New Development Bank (NDB) of the BRICS group has begun to offer loans in local currencies. This is according to the latest report from Natural News,

BRICS group motive to ditch the use of US dollarThe move to offer loans in local currencies is to steer away from the US dollar’s dependency. The plan to offer the loan was reportedly confirmed by NDB President Dilma Rousseff. She also stated that the bank aims to provide 30% of the loans in the local currencies of member nations.

Rousseff recently stated this in an April 14 interview with CGTN regarding the move. “It is necessary to find ways to avoid foreign exchange risk and other issues such as being dependent on a single currency, such as the U.S. dollar.” Also read: BRICS: Putin and Saudi Crown Prince Discuss OPEC+ Deal She also stressed during the interview that providing 30% of the loans in the local currencies of BRICS member countries will also help the countries avoid exchange rate risks and finance shortages.

|

|

BRICS: Ministers Say Global Order is Rebalancing from Western DominanceJoshua Ramos

BRICS foreign ministers are meeting in Cape Town over the next two days, where they have stated the global order is rebalancing away from Western dominance. Moreover, South Africa’s foreign minister, Naledi Pandor, discussed the collective vision for “global leadership,” amidst a fractured world.

Ministers from Brazil, Russia, India, China, and South Africa were in attendance. Subsequently, they spoke about the turning tide of the global power balance. Stating that the BRICS nations need to assure the multipolar order of the current world. BRICS Nations Speak of Rebalanced Global OrderThe BRICS nations have undoubtedly grown in prominence thus far in 2023. Indeed, nations have sought to join the collective that has proven to be a growing alternative to the G7 countries. With a combined population of over 3.2 billion, and making up 40% of people on the planet, BRICS have proven to be attractive to developing countries.

Nevertheless, in the meeting taking place today, the BBC reported the BRICS foreign ministers’ sentiments that the global order is rebalancing away from Western dominance. Specifically, Indian Minister Subrahmanyam Jaishankar discussed the necessity for the collective to “send out a strong message that the world is multipolar, that it is rebalancing, and that old ways cannot address new situations.”

“At the heart of the problems we face is economic concentration that leaves too many nations at the mercy of too few,” he added. Additionally, Brazilian Foreign Minister Mauro Viera shared their vision of the bloc. Specifically, describing it as an “indispensable mechanism for building a multipolar world order that reflects the devices and needs of developing countries.”

As the BRICS summit is set to arrive in a few months, the potential expansion of the bloc will be a vital talking point. Moreover, more than 20 nations have already reportedly submitted membership applications to join the bloc. The bloc continues to maintain its focus on challenging Western dominance. Subsequently, countries tired of the political stranglehold of the West are flocking.

|

|

BRICS Alliance Promoting Native Currency Before Launching New TenderVinod Dsouza

BRICS countries are promoting their native currency before launching a new tender in August 2023. The next BRICS summit will be held in South Africa and the BRICS nations Brazil, Russia, India, China, and South Africa will launch a new currency to settle international trade. The nations aim to remove the U.S. dollar from its global reserve status and overthrow the existing financial order.

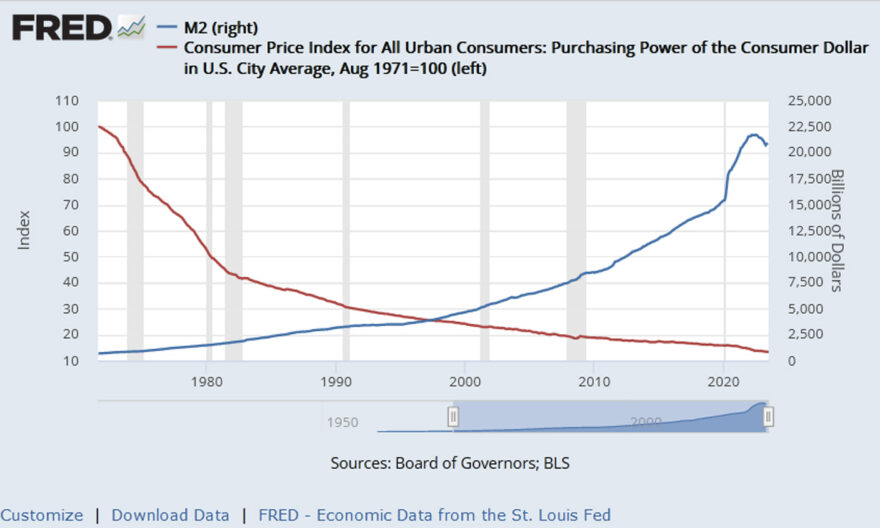

China is making use of the timeline by asking other developing nations to settle trade using the Chinese Yuan. In Q1 2023, the Chinese Yuan was the most traded currency in Russia overtaking the U.S. dollar. In addition, France settled an LNG gas trade with China by paying in the Chinese Yuan, ending the reliance on the dollar.

Also Read: 5 Arab Nations Ready To Join BRICS Alliance

On the other hand, India has asked developing countries to settle trade in the Rupee instead of the U.S. dollar. India reached out to countries that don’t have the U.S. dollar in reserve to pay for international trade, reported Bloomberg. The Reserve Bank of India allows 18 countries to pay with the Rupee instead of the dollar. Kenya, Sri Lanka, and Singapore are among the list of nations that India wants to trade with using its native currency Rupee.

Also Read: BRICS Countries Buying Large Amounts of Gold To Topple the U.S. Dollar BRICS Alliance Promotes Native CurrencySouth Africa’s BRICS ambassador, Anil Sooklal said that the block of nations must prioritize native currencies over the U.S. dollar. The development is the stepping stone to replace the dollar before they launch a new currency in August this year. In conclusion, the BRICS alliance of nations has already begun using their native currency for trade than the dollar.

Also Read: Will Canada & Mexico Join BRICS To Eliminate U.S. Dollar’s Dominance? “National currencies should be increasingly used by the BRICS states not only in trade but also in investments and other transactions. Only this way can the foundation for the single BRICS currency be created,” he said to Tass News.

|

|

10 ASEAN Countries To Accept BRICS CurrencyVinod Dsouza The ASEAN bloc of countries is looking to deepen ties with BRICS and accept the new currency for cross-border transactions. ASEAN nations recently agreed to ditch the U.S. dollar for global trade and are currently settling payments with native currencies. The leaders of the 10 Southwest Asian nations agreed to sideline the U.S. dollar and promote local currencies instead. Therefore, the dollar usage for international trade is reduced giving native currencies a boost in the global markets.

Also Read: Europe Might Get Ready To Accept BRICS Currency The 10 ASEAN countries recently signed a declaration to stop using the U.S. dollar similar to the BRICS alliance. The countries in the ASEAN bloc include Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand, and Vietnam.

While ASEAN has no plans to launch a new currency, they are dependent on BRICS to release a new tender. When the soon-to-be-released currency makes its way on the global stage, the ASEAN bloc could be the first to accept it. The bloc is moving to maintain ties with BRICS and begin to usher in a new era in the global financial markets.

Also Read: Saudi Arabia To Challenge U.S. Dollar’s Supremacy by Funding BRICS Alliance ASEAN Alliance Could be the First to Accept BRICS CurrencyThe official declaration signed by ASEAN leaders states that the U.S. dollar will be reduced to secondary status for global trade. The goal is to strengthen bilateral and multilateral payment activities among each other for imports and exports. The proximity of borders helps ASEAN to settle trade faster and more smoothly.

Apart from ASEAN, the Gulf Cooperation Council (GCC) is also aiming to end reliance on the U.S. dollar and accept BRICS. Read here to know more details on why GCC wants to challenge Western financial dominance.

Also Read: BRICS: 16 Asian Countries Move to Ditch the U.S. Dollar “We adopted the ASEAN Leaders Declaration on advancing regional payment connectivity and promoting local currency transaction to foster bilateral and multilateral payment connectivity arrangements to strengthen economic integration by enabling fast, seamless, and more affordable cross-border payments across the region,” the declaration read.

|

|

24 Countries Ready To Accept BRICS CurrencyVinod Dsouza

A total of 24 countries are interested in accepting and trading with BRICS currency when it launches on the International stage. The group of developing countries is moving to bypass the U.S. dollar to settle global trade. The dollar’s dominance could weaken if the BRICS currency gains prominence, giving Eastern nations more financial power than the United States.

South Africa’s BRICS ambassador Anil Sooklal said that 19 countries have shown their interest to join the alliance, reported Bloomberg. Sooklal confirmed that 13 countries have formally sent applications to join the BRICS alliance. He added that five other countries have informally requested to be a part of the block.

Also Read: BRICS Alliance Promoting Native Currency Before Launching New Tender BRICS comprises five countries Brazil, Russia, India, China, and South Africa. Therefore, a total of 24 countries are participating to dethrone the U.S. dollar from its global reserve status. 24 Countries Interested In BRICS CurrencyThe countries that have shown interest to join the BRICS alliance are Saudi Arabia, the United Arab Emirates, Argentina, Egypt, Bahrain, Indonesia, Algeria, and Iran. Also, two unnamed countries from East Africa and one from West Africa have sent their applications, according to the ambassador.

The development shows that a handful of countries are interested to trade in the BRICS currency. The nations want to move away from the U.S. dollar and end American financial supremacy. The dollar comes with a risk of debt that could wreak havoc on local currencies if the U.S. slips into a recession.

Also Read: BRICS Countries Buying Large Amounts of Gold To Topple the U.S. Dollar If more countries ditch the dollar, the U.S. will have no means to fund its deficit, making the dollar weak. This could make the soon-to-be-released BRICS currency gain prominence in the new financial world order.

If nations around the world settle for trade with the BRICS currency, the dollar’s value could plummet. Therefore, the fate of the U.S. dollar will be decided in the next BRICS summit.

|

|

Europe Might Get Ready To Accept BRICS Currency4June2023 https://watcher.guru/news/europe-ready-to-accept-brics-currency-u-s-dollar

A whirlwind of changes is taking place in the global financial markets threatening the superiority of the U.S. dollar. A handful of countries in Africa, Asia, Latin America, and Europe are looking to end reliance on the dollar and promote BRICS or their native currencies. Iraq banned the U.S. dollar in May, posing a hefty fine and jail term for anyone trading with the USD.

The Iraqi government banned entities from initiating business transactions with the U.S. dollar. Iraq aims to control the fluctuating black market exchange rate, that plagues the country for decades. The move is also positioned to strengthen the usage of the Iraqi Dinar in the Forex markets.

Offenders who trade in the U.S. dollar will face a penalty of up to 1 million Iraqi Dinar. Repeat offenders will also face a jail term of one year and have their business licenses overturned. Also Read: Saudi Arabia To Challenge U.S. Dollar’s Supremacy by Funding BRICS Alliance After Iraq Bans U.S. Dollar, Europe Could Accept BRICS CurrencyThe South African BRICS ambassador Anil Sooklal confirmed that European countries have expressed interest to join the BRICS alliance. Sooklal did not reveal the names of the European nations but hinted that a global financial change is brewing. According to recent developments, all arrows point towards France and Belarus showing interest to join BRICS. Also Read: BRICS: What Happens if Mexico Joins the Alliance? France settled an LNG gas trade with China by settling the cross-border transaction with the Chinese Yuan in March. French President Emmanuel Macron also called for the European Union to distance itself from the U.S. dollar.

In addition, Macron repeatedly hit out against the dollar calling it a “great risk” to continue trading with it. The dollar comes with the risk of debt that could spell trouble to nations holding it as reserves.

Also, the Eastern European country Belarus is interested to join BRICS and trade with the new currency. Belarus President Alexander Lukashenko suggested ideas to create a new economic union with zero restrictions with BRICS. If a barrier-less trade among BRICS countries takes shape, the U.S. dollar could be dethroned from the global reserve currency.

|

|

Saudi Arabia To Challenge U.S. Dollar’s Supremacy by Funding BRICS Alliance01June2023 https://watcher.guru/news/saudi-arabia-challenge-us-dollar-funding-brics-alliance

The oil-rich Saudi Arabia formally sent its application to join the BRICS alliance, reported Bloomberg. The South African BRICS ambassador Anil Sooklal confirmed that five Middle Eastern countries have shown their interest to join the bloc. The five countries are Saudi Arabia, the United Arab Emirates, Bahrain, Egypt, and Algeria. The nations export millions of oil barrels to the West every year settling transactions in the U.S. dollar.

Talks are in progress with Saudi Arabia looking to fund the BRICS bank, commonly called The New Development Bank (NDB). If the BRICS alliance accepts Saudi’s funding, it could usher in a new era of financial dominance with constant cash flow from the oil-rich nation. Saudi Arabia funding of the BRICS bank poses a challenge to the U.S. dollar’s supremacy as the global reserve currency.

Also Read: BRICS: China Does Not Want the Chinese Yuan To Replace U.S. Dollar as Reserve Currency BRICS: Saudi Arabia Challenges U.S. Dollar’s Global Currency StatusThe BRICS bank President Dilma Rousseff said on Tuesday that the alliance is keen on receiving funds from Saudi Arabia. Moreover, the decision to allow Saudi cash flow for NDB will be jointly taken by the bloc of nations at the next summit in South Africa in August.

Also Read: What Happens to the U.S. Dollar if BRICS Launch New Currency?

“As a former president of a developing country, I know how important multilateral banks are. And how much of a challenge it is to obtain finance or to raise funds on the scale needed to address social and economic challenges in our countries,” said Rousseff.

Rousseff stated that the BRICS bank aims to fund projects in local currencies thereon and not the U.S. dollar. The development could end reliance on the U.S. dollar and strengthen the BRICS currency on a global scale. Nonetheless, the dollar’s dominance is being chipped piece-by-piece as we know it and could make way for a new financial order.

Also Read: After BRICS, 10 ASEAN Countries Ditch The U.S. Dollar

BRICS is an acronym for Brazil, Russia, India, China, and South Africa. Nearly 25 countries have shown their interest to join the alliance. BRICS could soon turn to BRICS+ if more countries are allowed to enter the bloc and become financially more powerful.

|

|

BRICS: Saudi Arabia & India’s New Energy Deal a ‘Game Changer’Joshua Ramos

Indian Prime Minister Narendra Modi meets with Crown Prince Of Saudi Arabia Mohammed Bin Salman Bin Abdulaziz Al-Saud Source: Nikkei Asia The two BRICS countries, Saudi Arabia and India, have signed a new energy deal that has certainly been labeled a “game changer.” Moreover, the two nations have already agreed to expand economic ties. The decision arrived after Saudi Arabia was invited to join the bloc at last month’s 2023 economic summit.

The economic alliance saw six countries join its ranks in its first expansion effort since its inception. Saudi Arabia joined the United Arab Emirates (UAE), Iran, Egypt, Ethiopia, and Argentina as part of key expansion efforts. Subsuenqlety’s deals with India show the fruit of that decision. Also Read: BRICS Influence in Oil Sector Grows, Puts US Dollar in Danger Saudi Arabia and India Sign New Energy Agreement Labeled a “Game Changer.”The growth in economic ties between Saudi Arabia and India has been a notable development. Specifically, the two BRICS nations have seen their economic integration lead to agreements that could have massive implications. That trend has continued once again today.

Indeed, the BRICS nations of Saudi Arabia and India have signed a new energy agreement that has been labeled a “game changer.” Moreover, the deal will see the former aid India in its energy transition. The country’s Power and Energy Minister, R.K. Singh, noted that it could be of immense importance in the near term. Also Read: Economist Predicts Tradig Ending to US Dollar Specifically, both countries have signed a memorandum of understanding on energy cooperation. The deal has placed its emphasis on energy efficiency as well as renewable energy and green hydrogen. Subsequently, it has directed both nations toward energy efficiency, with a grid interconnected between the two nations.

“The advantage will be that renewable energy will be available around the clock because they are in different time zones, so the sun always shines in different time zones,” Singh told Arab News. “It is a game changer. The cost of electricity will come down for the entire region, for the entire Middle East, for our subcontinent, and also for Southeast Asia.”

|

|

BRICS: What Happens if Mexico Joins the Alliance?01June2023 https://watcher.guru/news/brics-what-happens-if-mexico-joins-the-alliance

Mexico is among the 19 countries that have expressed interest to join BRICS but has not formally sent its application, reported Bloomberg. If Mexico officially applies to join the BRICS alliance, the move could cause a paradigm shift in cross-border transactions.

The move could impact its relations with other countries, including its neighboring counties the United States and Canada. The U.S. dollar’s global status could be challenged and put to the test if Mexico accepts the upcoming BRICS currency.

Also Read: BRICS: China Does Not Want the Chinese Yuan To Replace U.S. Dollar as Reserve Currency What Happens If Mexico Joins the BRICS Alliance & Accepts the New Currency?Mexico’s alignment with BRICS could alter the geopolitical dynamics in the North and Latin American region. It may result in the reconfiguration of alliances and partnerships, potentially impacting Mexico’s relationships with other countries, particularly those outside BRICS. The move could also lead to closer ties with BRICS members and reshape global power dynamics.

Also Read: What Happens to the U.S. Dollar if BRICS Launch New Currency?

In addition, Mexico accepting BRICS currency for international trade could pave the way for Latin American countries to cut ties with the U.S. dollar. The BRICS currency could capture the Latin American markets making other nations end reliance on the U.S. dollar.

Mexico’s participation might be an important gateway for the BRICS currency to access and trade in the Latin American markets. The move might extend to areas such as diplomacy, security, and cultural exchanges, fostering closer relationships among the participating nations.

However, Mexico has not joined the BRICS alliance currently and is partnered with the United States and Canada through NAFTA. A decision to be a part of the bloc through BRICS+ is yet to be decided by the government.

BRICS is an acronym for Brazil, Russia, India, China, and South Africa. The next summit will be held in South Africa in August, where members will decide on the formation of a new currency.

|

|

BRICS: Here’s a Full List of Countries That Wants To Join the AllianceVinod Dsouza

BRICS was created on June 16, 2019, and it compromises Brazil, Russia, India, China, and South Africa. The alliance is taking on the U.S. dollar with plans to launch a new currency to settle payments for international trades. The move is attracting other Eastern countries into the bloc as they want to end reliance on the dollar and promote native currencies.

In addition, developing nations from Africa, the Middle East, and South East Asia are ready to join the BRICS alliance. In this article, we will highlight how many countries have shown their interest in joining the BRICS bloc.

Also Read: Middle East Countries Look To Join BRICS Alliance Full List of Countries That Have Shown Interest in Joining BRICSDiscussing the expansion of BRICS to BRICS+ is currently underway and could be decided in the next summit on August 2023. The countries that have shown interest in joining BRICS are: Algeria Among all the nations, Algeria, Argentina, Bahrain, Egypt, Indonesia, Iran, Saudi Arabia, and the United Arab Emirates have formally applied to join the BRICS alliance. The other nations have only expressed their interest in joining the BRICS bloc.

Also Read: 24 Countries Ready To Accept BRICS Currency The next BRICS summit will be held in Cape Town, South Africa in August 2023. The five-nations bloc will combinedly decide on the launch of a new currency to settle global trade. The development has placed the U.S. dollar on the back foot as the world will rely less on the greenback. The move could add further pressure on the dollar sending it on a path of decline.

However, the Federal Reserve plans to challenge BRICS by launching a new FedNow payment service. FedNow will be an instant money transfer platform and banks and leading financial institutions will adopt the new financial technology. Read here to know how FedNow plans to take on the yet-to-be-released BRICS currency and stunt its growth.

|

|

G7 Vs BRICS – Off To The Racesby Tyler Durden, 25March2023 – https://www.zerohedge.com/geopolitical/g7-vs-brics-races Authored by Scott Ritter via ConsortiumNews.com, An economist digging below the surface of an IMF report has found something that should shock the Western bloc out of any false confidence in its unsurpassed global economic clout… Last summer, the Group of 7 (G7), a self-anointed forum of nations that view themselves as the most influential economies in the world, gathered at Schloss Elmau, near Garmisch-Partenkirchen, Germany, to hold their annual meeting. Their focus was punishing Russia through additional sanctions, further arming of Ukraine and the containment of China.

At the same time, China hosted, through video conference, a gathering of the BRICS economic forum. Comprised of Brazil, Russia, India, China and South Africa, this collection of nations relegated to the status of so-called developing economies focused on strengthening economic bonds, international economic development and how to address what they collectively deemed the counter-productive policies of the G7.

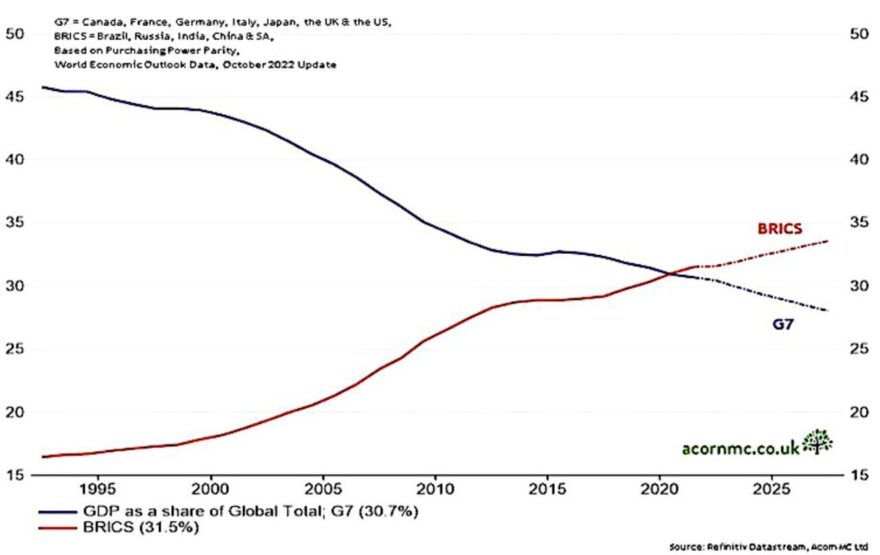

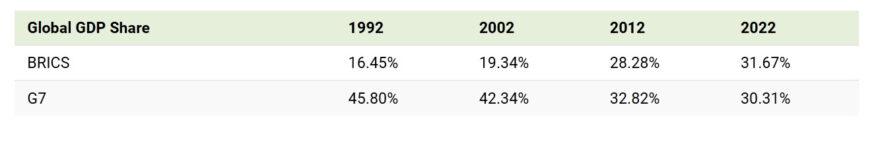

In early 2020, Russian Deputy Foreign Minister Sergei Ryabkov had predicted that, based upon purchasing power parity, or PPP, calculations projected by the International Monetary Fund, BRICS would overtake the G7 sometime later that year in terms of percentage of the global total.

(A nation’s gross domestic product at purchasing power parity, or PPP, exchange rates is the sum value of all goods and services produced in the country valued at prices prevailing in the United States and is a more accurate reflection of comparative economic strength than simple GDP calculations.)

Then the pandemic hit and the global economic reset that followed made the IMF projections moot. The world became singularly focused on recovering from the pandemic and, later, managing the fallout from the West’s massive sanctioning of Russia following that nation’s invasion of Ukraine in February 2022.

The G7 failed to heed the economic challenge from BRICS, and instead focused on solidifying its defense of the “rules based international order” that had become the mantra of the administration of U.S. President Joe Biden. MiscalculationSince the Russian invasion of Ukraine, an ideological divide that has gripped the world, with one side (led by the G7) condemning the invasion and seeking to punish Russia economically, and the other (led by BRICS) taking a more nuanced stance by neither supporting the Russian action nor joining in on the sanctions. This has created a intellectual vacuum when it comes to assessing the true state of play in global economic affairs.  U.S. President Joe Biden in virtual call with G7 leaders and Ukrainian President Volodymyr Zelenskyy, Feb. 24. (White House/Adam Schultz) It is now widely accepted that the U.S. and its G7 partners miscalculated both the impact sanctions would have on the Russian economy, as well as the blowback that would hit the West. Angus King, the Independent senator from Maine, recently observed that he remembers

It should be noted that the IMF calculated that the Russian economy, as a result of these sanctions, would contract by at least 8 percent. The real number was 2 percent and the Russian economy — despite sanctions — is expected to grow in 2023 and beyond.

This kind of miscalculation has permeated Western thinking about the global economy and the respective roles played by the G7 and BRICS. In October 2022, the IMF published its annual World Economic Outlook (WEO), with a focus on traditional GDP calculations. Mainstream economic analysts, accordingly, were comforted that — despite the political challenge put forward by BRICS in the summer of 2022 — the IMF was calculating that the G7 still held strong as the leading global economic bloc.

In January 2023 the IMF published an update to the October 2022 WEO, reinforcing the strong position of the G7. According to Pierre-Olivier Gourinchas, the IMF’s chief economist, the “balance of risks to the outlook remains tilted to the downside but is less skewed toward adverse outcomes than in the October WEO.”

This positive hint prevented mainstream Western economic analysts from digging deeper into the data contained in the update. I can personally attest to the reluctance of conservative editors trying to draw current relevance from “old data.”

Fortunately, there are other economic analysts, such as Richard Dias of Acorn Macro Consulting, a self-described “boutique macroeconomic research firm employing a top-down approach to the analysis of the global economy and financial markets.”

Rather than accept the IMF’s rosy outlook as gospel, Dias did what analysts are supposed to do — dig through the data and extract relevant conclusions.

After rooting through the IMF’s World Economic Outlook Data Base, Dias conducted a comparative analysis of the percentage of global GDP adjusted for PPP between the G7 and BRICS, and made a surprising discovery: BRICS had surpassed the G7.

This was not a projection, but rather a statement of accomplished fact:

Making matters worse for the G7, the trends projected showed that the gap between the two economic blocs would only widen going forward. The reasons for this accelerated accumulation of global economic clout on the part of BRICS can be linked to three primary factors:

Growth DisparitiesIt is true that BRICS and G7 economic clout is heavily influenced by the economies of China and the U.S., respectively. But one cannot discount the relative economic trajectories of the other member states of these economic forums. While the economic outlook for most of the BRICS countries points to strong growth in the coming years, the G7 nations, in a large part because of the self-inflicted wound that is the current sanctioning of Russia, are seeing slow growth or, in the case of the U.K., negative growth, with little prospect of reversing this trend.

Moreover, while G7 membership remains static, BRICS is growing, with Argentina and Iran having submitted applications, and other major regional economic powers, such as Saudi Arabia, Turkey and Egypt, expressing an interest in joining. Making this potential expansion even more explosive is the recent Chinese diplomatic achievement in normalizing relations between Iran and Saudia Arabia.

Diminishing prospects for the continued global domination by the U.S. dollar, combined with the economic potential of the trans-Eurasian economic union being promoted by Russia and China, put the G7 and BRICS on opposing trajectories. BRICS should overtake the G7 in terms of actual GDP, and not just PPP, in the coming years. But don’t hold your breath waiting for mainstream economic analysts to reach this conclusion. Thankfully, there are outliers such as Richard Dias and Acorn Macro Consulting who seek to find new meaning from old data. |

|

Watch: G7 Vs BRICS By GDP (1992-2028)by Tyler Durden, 31July2023 – https://www.zerohedge.com/economics/watch-g7-vs-brics-gdp-1992-2028

Fifty years ago, the government finance heads from the UK, West Germany, France, and the U.S. met informally in the White House’s ground-floor library to discuss the international monetary situation at the time. This is the origin story of the G7.

This initial group quickly expanded, adding Japan, Italy, and Canada, to solidify a bloc of the biggest non-communist economies at the time. As industrialized countries that were reaping the benefits of the post-war productivity boom, they were economic juggernauts, with G7 economic output historically contributing around 40% of global GDP.

However, as Visual Capiutalist’s Pallavi Rao details below, the more recent emergence of another international group, BRICS (Brazil, Russia, India, China, and South Africa), has been carving out its own section of the global economic order. This animation from James Eagle uses data from the International Monetary Fund (IMF) and charts the percentage contribution of the G7 and BRICS members to the world economy. Specifically it uses GDP adjusted for purchasing power parity (PPP) using international dollars. Click to Play BRICS Economies Surpass G7 in Global GDP ShareCharting the Rise of BRICS vs. G7The acronym “BRIC”, developed by Goldman Sachs economist Jim O’Neill in 2001, was used to identify four fast-growing economies in similar stages of development. It wasn’t until 2009 that their leaders met and formalized their relationship, later inviting South Africa to join in 2010.

ℹ️ Russia was at the time also a member of the G7, then the G8. It was invited to join in 1997 but was expelled in 2014 following the annexation of Crimea.

While initially banded together for investment opportunities, in the last decade, BRICS has become an economic rival to G7. Several of their initiatives include building an alternate global bank, with dialogue underway for a payment system and new reserve currency. Below is a quick look at both groups’ contribution to the world economy in PPP-adjusted terms.

A major contributing factor to BRICS’ rise is Chinese and Indian economic growth.

After a period of rapid industrialization in the 1980s and 1990s, China’s exports got a significant boost after it joined the World Trade Organization in 2001. This helped China become the world’s second largest economy by 2010.

India’s economic rise has not been quite as swift as China’s, but by 2022, the country ranked third with a gross domestic product (PPP) of $12 trillion. Together the two countries make up nearly one-fourth of the PPP-adjusted $164 trillion world economy.

The consequence of using the PPP metric—which better reflects the strengths of local currencies and local prices—is that it has an outsized multiplier effect on the GDPs of developing countries, where the prices of domestic goods and services tend to be cheaper.

Below, we can see both the nominal and PPP-adjusted GDP of each G7 and BRICS country in 2023. Nominal GDP is measured in USD with market-rate currency conversion, while the adjusted GDP uses international dollars (using the U.S. as a base country for calculations) which better account for cost of living and inflation.

By the IMF’s projections, BRICS countries will constitute more of the world economy in 2023 ($56 trillion) than the G7 ($52 trillion) using PPP-adjusted GDPs. How Will BRICS and G7 Compare in the Future?China and India are in a stage of economic development marked by increasing productivity, wages and consumption, which most countries in the G7 had previously enjoyed in the three decades after World War II.

By 2028, the IMF projects BRICS countries to make up one-third of the global economy (PPP):

BRICS vs. the World?The economic rise of BRICS carries geopolitical implications as well. Alongside different political ideals, BRICS’ increasing power gives its member countries financial muscle to back them up. This was put into sharp perspective after the 2022 Russian invasion of Ukraine, when both China and India abstained from condemning the war at the United Nations and continued to buy Russian oil.

While this is likely concerning for G7 countries, the group of developed countries still wields unparalleled influence on the global stage. Nominally the G7 still commands a larger share of the global economy ($46 trillion) than BRICS ($27.7 trillion). And from the coordination of sanctions on Russia to sending military aid to Ukraine, the G7 still wields significant influence financially and politically.

In the next few decades, especially as China and India are earmarked to lead global growth while simultaneously grappling with their own internal demographic issues, the world order is only set to become more complex and nuanced as these international blocs vie for power.

|

|

NATOstan Robots Versus the Heavenly Horses of MultipolarityPepe Escobar29August2023 https://strategic-culture.su/news/2023/08/29/natostan-robots-versus-the-heavenly-horses-of-multipolarity/

The entire West is waiting at the room at the station with black curtains – and no trains. Join us on Telegram, Twitter, and VK. We will all need plenty of time and introspection to analyze the full range of game-changing vectors unleashed by the unveiling of BRICS 11 last week in South Africa.

Yet time waits for no one. The Empire will (italics mine) strike back in full force; in fact its multi-hydra Hybrid War tentacles are already on display.

Here and here I have attempted two rough drafts of History on the birth of BRICS 11. Essentially, what the Russia-China strategic partnership is accomplishing, one (giant) step at a time, is also multi-vectorial: – expanding BRICS into an alliance to fight against U.S. non-diplomacy. – counter-acting the sanctions dementia. – promoting alternatives to SWIFT. – promoting autonomy, self-reliance and instances of sovereignty. – and in the near future, integrating BRICS 11 (and counting) with the Shanghai Cooperation Organization (SCO) to counter imperial military threats, something already alluded to by President Lukashenko, the inventor of the precious neologism “Global Globe”.

In contrast, the indispensable Michael Hudson has constantly shown how the U.S. and EU’s “strategic error of self-isolation from the rest of the world is so massive, so total, that its effects are the equivalent of a world war.”

Thus Prof. Hudson’s contention that the proxy war in Ukraine – not only against Russia but also against Europe – “may be thought of as World War III.”

In several ways, Prof. Hudson details, we are living “an outgrowth of World War II, whose aftermath saw the United States establish international economic and political organization under its own control to operate in its own national self-interest: the International Monetary Fund to impose U.S. financial control and dollarize the world economy; the World Bank to lend governments money to bear the infrastructure costs of creating trade dependency on U.S. food and manufactures; promoting plantation agriculture, U.S./NATO control of oil, mining and natural resources; and United Nations agencies under U.S. control, with veto power in all international organizations that it created or joined.”

Now it’s another ball game entirely when it comes to Global South, or Global Majority, of “Global Globe” real emancipation. Just take Moscow hosting the Russia-Africa summit in late July, then Beijing, with Xi in person, spending a day last week in Johannesburg with dozens of African leaders, all of them part of the new Non-Aligned Movement (NAM): the G77 (actually 134 nations), presided by a Cuban, President Diaz-Canel.

That’s the Russia-China Double Helix in effect – offering large swathes of the “Global Globe” security and high-tech infrastructure (Russia) and finance, manufactured exports and road and rail infrastructure (China).

In this context, a BRICS currency is not necessary. Prof. Hudson crucially quotes President Putin: what’s needed is a “means of settlement” for Central Banks for their balance of payments, to keep in check imbalances in trade and investment. That has nothing to do with a BRICS gold-backed supra-national currency.

Moreover, there will be no need for a new reserve currency as increasingly more nations will be ditching the U.S. dollar in their settlements.

Putin has referred to a “temporary” accounting unit – as intra-BRICS 11 trade will be inevitably expanding in their national currencies. All that will develop in the context of an increasingly overwhelming alliance of major oil, gas, minerals, agriculture and commodities producers: a real (italics mine) economy capable of supporting a new global order progressively pushing Western dominance into oblivion.

Call it the soft way to euthanize Hegemony. All aboard the “malign China” narrativeNow compare all of the above with that piece of Norwegian wood posing as NATO secretary-general telling the CIA mouthpiece paper in Washington, in a unique moment of frankness, that the Ukraine War “didn’t start in 2022. The war started in 2014”.

So here we have a designated imperial vassal plainly admitting that the whole thing started with Maidan, the U.S.-engineered coup supervised by cookie distributor Vicky “F**k the E” Nuland. This means that NATO’s claim of a Russia “invasion”, referring to the Special Military Operation (SMO) is absolutely bogus from a legal standpoint.

It’s firmly established that the spin doctors/ paid propagandist “experts” of Atlanticist idiocracy, practicing an unrivalled mix of arrogance/ignorance, believe they can get away with anything when it comes to demonizing Russia. The same applies to their new narrative on “malign China”.

Chinese scholars which I have the honor to interact with are always delighted to point out that imperial pop narratives and predictive programming are absolutely useless when it comes to confronting Zhong Hua (“The Splendid Central Civilization”).

That’s because China, as one of them describes it, is endowed with a “clear-minded, purposeful and relentless aristocratic oligarchy at the helm of the Chinese State”, using tools of power that guarantee, among other issues, public safety and hygiene for all; education focused on learning useful information and skills, not indoctrination; a monetary system under control; physical assets and the industrial capacity to make real stuff; first-class diplomatic, supply chain, techno-scientific, economic, cultural, commercial, geostrategic and financial networks; and first-class physical infrastructure.

And yet, since at least 1990, Western mainstream media is obsessed to dictate that China’s economic collapse, or “hard landing”, is imminent.

Nonsense. As another Chinese scholar frames it, “China’s strategy has been to let sleeping dogs lie and let lying machines lie. Meanwhile, let China surpass them in their sleep and cause the Empire’s demise.” Poisons, viruses, microchipsAnd that bring us full circle back to the New Great Game: NATOstan versus the Multipolar World. No matter the evidence provided by graphic reality, NATOstan in advanced seppuku mode – especially the European sector – actually believes it will win the war against Russia-China.

As for the Global South/Global Majority/”Global Globe”, they are regarded as enemies. So their mostly poor populations should be poisoned with famine, experimental injections, new modified viruses, implanted microchips as in BCI (Brain Computer Interface) and soon NATO As Global Robocop “security” outfits.

The coming of BRICS 11 is already unleashing a new imperial wave of deadly poisoning, brand new viruses and cyborgs. The imperial master issued the order to “save” the Japanese seafood industry – a few scraps as quid pro quod for Tokyo acting as a rabid dog in the imperial Chip War against China, and dutifully pledging alliance at the recent Camp David summit side by side with the South Korean vassals.

The EU vassals, in synch, lifted Japan food import rules just as Fukushima nuclear wastewater was to be pumped into the ocean. That’s yet another instance of the EU continuing to dig its own grave – as Japan is set to suffer a Typhoon Number Ten type of blowback.

Radiation spread across the world through the Pacific will breed endless cancer patients around the world and simultaneously destroy the economy of several small island nations relying heavily on tourism.

In parallel, Sergey Glazyev, Minister of Macroeconomics at the Eurasian Economic Commission, part of the EAEU, has been among the very few warning about the new trans-humanist frontier: the Nanotechnology Injection craze ahead – something quite well documented in scientific journals.

Quoting Dr. Steve Hotze, Glazyev in one of his Telegram posts explained what DARPA (Defense Advanced Research Projects Agency) has been doing, “injecting nanobots in the form of graphene oxide and hydrogel” into the human body, thus creating an interface between nanobots and brain cells. We become “a receptor, receiver and transmitter of signals. The brain will receive signals from the outside, and you can be manipulated remotely.”

Glazyev also refers to the by now frantic promotion of “Eris”, a new Covid variety, named by the WHO after the Greek goddess of discord and enmity, daughter of the goddess of night, Nykta.

Those familiar with Greek mythology will know that Eris was quite angry because she was not invited to the wedding of Peleus and Thetis. Her vengeance was to plant at the feast a golden apple from the gardens of Hesperides with the inscription “Most Beautiful”: that was the legendary “apple of discord”, which generated the Mother of All Catfights between Hera, Athena and Aphrodite. And that eventually led to no less than the Trojan War. In the White Room, with black curtainsIt’s oh so predictable, coming from those “elites” running the show, to name a new virus as a harbinger of war. After all, The Next War is badly needed because Project Ukraine turned out to be a massive strategic failure, with the cosmic humiliation of NATO just around the corner.

During the Vietnam War – which the empire lost to a peasant guerrilla army – the daily briefing at the command HQ in Saigon was derided by every journalist with an IQ above room temperature as the “Saigon follies”.

Saigon would never compare with the tsunami of daily follies offered on the proxy war in Ukraine by a tawdry moveable feast at the White House, State Dept., Pentagon, NATO HQ, the Brussels Kafkaesque machine and other Western environs. The difference is that those posing as “journalists” today are cognitively incapable of understanding these are “follies” – and even if they did, they would be prevented from reporting them.

So that’s where the collective West is at the moment: in a White Room, a simulacrum of Plato’s cave depicted in Cream’s 1968 masterpiece, partly inspired by William Blake, invoking pale “silver horses” and exhausted “yellow tigers”.

The entire West is waiting at the room at the station with black curtains – and no trains. They will “sleep in this place with the lonely crowd” and “lie in the dark where the shadows run from themselves”.

Outside in the cold, long distance, under the sunlight, away from the moving shadows, across roads made of silk and iron, the Heavenly Horses (Tianma) of the multipolar world gallop gallantly from network to network, from Belt and Road to Eurasia and Afro-Eurasia Bridge, from intuition to integration, from emancipation to sovereignty. |

|

Escobar: Putin And The Magic Multipolar Mountainby Tyler Durden, 08October2023 – https://www.zerohedge.com/geopolitical/escobar-putin-and-magic-multipolar-mountain

There was a whiff of Thomas Mann’s ‘The Magic Mountain’ at the 20th Valdai annual meeting this week at a hotel over the gorgeous heights of the Krasnaya Polyana. north-west of the picturesque resort Sochi.  Russian President Vladimir Putin and Chairman of Council on Foreign and Defence Policy, Editor-in-Chief of Russia in Global Affairs journal Fyodor Lukyanov attend a plenary session as part of the 20th annual meeting of the Valdai Discussion Club titled “Fair Multipolarity: How to Ensure Security and Development for Everyone” in Sochi, Krasnodar region, Russia. © Sputnik / Григорий Сысоев

But instead of a deep dive into the lure and degeneracy of ideas in an introverted community in the Swiss Alps on the eve of the First World War, we immersed ourselves in powerful new ideas expressed by a community of Global Majority intellectuals on the possible eve of a psycho neocon-intended WWIII.

And then, of course, President Putin intervened, striking the plenary session like lightning. This is an unofficial Top Ten of his address, before the Q&A which was characteristically engaging:

On The Road to “Asynchronous Multipolarity”The theme of Valdai 2023 was, most appropriately, ‘Fair Multipolarity’. The key axes of discussion were presented in this provocative, detailed report. It’s as if the report had prepared the stage for Putin’s address and his carefully crafted answers to the questions from the plenary.

The concept of multipolarity in the Russian space was first articulated by the late, great Yevgeny Primakov in the mid-Nineties. Now, the road to multipolarity is based on Foreign Minister Sergey Lavrov’s concept of “strategic patience”.

In a crisscrossed cornucopia of nation-states, larger blocs, security blocs and ideological historic blocs, we’re now deep into mega-alignments – even as the political West cultivates its universalist ambitions. The Eurasian “non-bloc” is in fact a mega-alignment, as much as the revitalized Non-Aligned Movement (NAM), which finds its expression in the G77 (actually formed by 134 nations).

The ideal path to follow might be horizontalism – in a Deleuze-Guattari sense – where we would have 200 equal nation-states. Of course the collective West won’t allow it. Andrey Shushentov, Dean of the School of International Relations at MGIMO University, proposes the notion of “asynchronous multipolarity”. Radhika Desai of Manitoba University proposes “pluripolarity” – borrowing from Hugo Chavez.

The risk, as expressed by Turkish political scientist Ilter Turan, is that by trying to build a replica of the present system via, for instance, BRICS 11, we may be racing towards a parallel system that simply cannot organize itself as the leader of a new order. So, a clearly possible outcome is a bipolar system – considering the impossible convergence of common values.

At the same time, a South-east Asian perspective, expressed by the President of the Diplomatic Academy of Vietnam, Pham Lan Dung, points to what is really relevant for middle and small countries: everything should proceed on the basis of South-South friendships. The BRICS Bank: It’s ComplicatedIn one of the key panels on BRICS as a prototype of a new international architecture, the star of the show was Brazilian economist Paulo Nogueira Batista Jr, who drew on his vast former experience at the IMF and as Vice-President of the NDB – the BRICS bank – for a realist presentation.

The key problem of the NDB is how to maintain unity while navigating power politics and reaching the upcoming stages of de-dollarization.

Batista outlined how a new international financial architecture may imply a future common currency. He stressed the success of implementing two practical experiments: a BRICS monetary fund (called the Contingent Reserve Agreement, CRA) and a multilateral development bank, the NDB.

Progress though “has been slow”. The monetary fund “has been frozen by the five Central Banks”, and must be expanded. Links with the IMF “must be severed”, but that incurs “fierce resistance” by the five Central Banks of BRICS members (and soon there will be 11).

Turning the NDB around will be a Sisyphean task. Disbursement of loans as well as project implementation have been “slow”. The US dollar “is the unit of account for the bank” – which in itself is counter-productive. The NDB is far from being a global bank: only three countries so far have joined. Current NDB President Dilma Rousseff has only two years to turn it around.

Batista remarked how the common currency idea first came from Russia, and was instantly embraced by Lula when he was Brazil’s President in the 2000s. The R5 concept – the currencies of all current five BRICS members start with a “R” – may endure; but now that will have to expand to R11.

The first substantial step ahead, after revamping the NDB, should be a currency from an issuing bank backed by bonds guaranteed by member countries, freely convertible, with currency swaps denominated in R5.

A healthy prospect is that Russia will appoint the next bank President starting in 2025. So the way forward substantially depends on Russia and Brazil, Batista emphasized. At the BRICS 11 summit in Kazan in south-west Russia next year, “a key decision should be made”. And during the Brazilian BRICS presidency in 2025, “the first practical steps should be announced”. Looking For a New UniversalityAlmost all panels at Valdai focused on how to develop an alternative system, but the two main themes were inevitably the lack of democracy in current international institutions and the weaponization of the US dollar. Batista correctly observed how the US itself is the main enemy of the US dollar when using it as a weapon.

At the Q&A, Putin addressed the key issue of economic corridors. He noted how BRI and the Eurasia Economic Union (EAEU) might have different interests: “Not true. They are harmonious and complement each other”. This is reflected in how they are geared to “ensure new logistic routes and industrial chains”, and all that “complemented by the real productive sector”.

Going forward, there’s a pressing need to coin a new terminology for this emerging new “universality” – even as nations continue to behave most often by following national interests.

What’s clear is that the collective West’s “universality” is not valid anymore. A remarkable panel on ‘Russian Civilization Through the Centuries’ showed how the notion of “universality” actually entered Western civilization through St Paul – after his Damascus moment – whereas the Indian notion of equilibrium inbuilt in the Upanishads would be way more appropriate.

Still, we are now in hot debate over the notion of the “civilization-state”, as configured mostly by India and China, Russia and Iran.

Pierre de Gaulle, grandson of the iconic General, expanded on the French notion of universality, embodied in the much-quoted slogan “liberté, egalité, fraternité” – not exactly upheld by Macronism. He made a point to stress he was the “sole representative of France” at Valdai (only a handful of European academics came to Sochi, and no diplomats).

De Gaulle reminded everyone how Saint Simon was a Russophile and how Voltaire corresponded with Catherine the Great. He alluded to the deep Franco-Russian cultural ties; a “shared community of interests”; and “the bond of Christianity”.

In contrast, crucially, “the US never accepted that Russia could develop under a different model”. And now that is illustrated by “how little today’s intellectual elites in the West know about Eurasia.”

De Gaulle emphasized the “tragic mistake is to see Russia through Western eyes”. He invoked Dostoevsky as he lamented the current “destruction of family values” and “existential void” inbuilt in the process of manufacturing consent. He pledged to “fight for independence”, just like his grandfather, under the seal of “faith, family and honor”, and stressed “we must rethink Europe”, inviting “war profiteers to come to Russia”. Top of The Hill: a Cathedral or a Fortress?Beyond Valdai, and especially throughout the crucial year of 2024 – while Russia holds the presidency of BRICS – there will be much further discussion about “poles” of ancient civilizations. A broad coalition of states that support multipolarity actually do not support the “civilization” concept; instead, they support the notion of people sovereignty.

It was up to Dayan Jayatilleka, former Sri Lankan plenipotentiary ambassador to Russia, to come up with a brilliant formulation.

He showed how Vietnam faced a proxy war against the hegemon successfully – “using 5,000 years of Vietnamese civilization”. That was “an internationalist phenomenon”. Ho Chi Minh took his ideas from Lenin – while enjoying full support from students in the US and Europe.

Russia might therefore learn from the Vietnamese experience how to conquer young hearts and minds across the West for its quest towards multipolarity.

It was clear to the overwhelming majority of analysts at Valdai that the concept of Russian civilization is an “existential challenge” to the collective West. Especially because it includes, historically, the radical universality of the Soviet Union. Now is time for Russian thinkers to work hard on refining the internationalist aspect.

Alexander Prokhanov came up with another startling formulation. He compared the Russian dream with a cathedral on the top of a hill, whereas the Anglo-Saxon dream is a fortress on the top of the hill, engaged in constant surveillance. And if you misbehave, you “will receive some Tomahawks”.

The conclusion: “We will always be in conflict with the West”. So what? The future, as I discussed off the record with Grandmaster Sergey Karaganov, one of the founders of Valdai, is in the East.

And it was Karaganov who arguably posed the most challenging question to Putin. He stressed how nuclear deterrence does not work anymore. So should we lower the nuclear threshold?”

Putin replied, “I am well aware of your position. Let me remind you the Russian military doctrine has two reasons for the possible use of nuclear weapons. The first is if nuclear weapons are used against us – as retaliation. The response is absolutely unacceptable for any potential aggressor. Because from the moment a missile launch is detected, no matter where it comes from – anywhere in the world’s oceans or from any territory – in a retaliatory strike, so many, so many hundreds of our missiles appear in the air that no enemy will have a chance of survival, and in several directions at once.”

The second reason is “a threat to the existence of the Russian state even if only conventional weapons are used.”

And then came the clincher – actually a veiled message to the characters whose dream is “victory” via a first strike: “Do we need to change that? Why? I see no point. There’s no situation when something can threaten the existence of the Russian state. No sane person would consider the use of nuclear weapons against Russia.” |

|

BRICS On The Marchby Tyler Durden, 30June2023 – https://www.zerohedge.com/markets/brics-march More and more countries have aspired to belong to BRICS since 2009, but none from the West. The BRICS countries represent 40% of the world population and 25% of the global GDP.

Thanks to BRICS, China can impose its vision of international cooperation and Russia can show that it will not be isolated on the stage of global players.

The group is a thorn in the side of the Americans all the more so that a dozen other developing countries (marked in orange on the map below) want to join the current five countries of the alliance (red). Source: Silkroadbriefing

What America certainly doesn’t like is the fact that French President Macron communicated the other day his interest in attending meetings of the alliance. France in BRICS would be a trigger for profound changes in the geopolitical landscape. We bet that Turkey can also join soon, which, like the case of France, will weaken the importance of the UN as a purely Anglo-Saxon project and that of NATO. Indeed, the BRICS countries are against the UN’s attempts to link the issues of climate with the issues of security, and France in BRICS can return to the de Gaullean concepts of foreign policy outside NATO.

A challenge to cohesion in BRICS is the large disparity in countries’ capacities (in favor of China) and the members’ focus on cooperation with the PRC, which results in a smaller number of relationships among the other partners. However, the main factor that has weakened the BRICS in recent years is the deterioration of relations between the largest member states, China and India, since 2017. Border and trade disputes culminated in the clashes on the Ladakh border in June 2020, which almost led to the cancellation of the BRICS summit in the same year and prompted India to deepen cooperation with the United States and the EU.

Now, the West’s involvement in the war in Ukraine is reviving anti-Western sentiments, not only in the BRICS countries.

Indeed, it is clear to more and more countries that the war was provoked by NATO’s excessive expansion.

The BRICS politicians also want to fight inflation whose cause they perceive not in the Russian attack but in the Western sanctions.

Whether you are pro-Western, pro-Russian, or in favor of the New Silk Road, it is better for all of us to live in a multi-polar world rather than to have all the strings pulled on the Potomac. |

|

BRICS Will Change The World… Slowlyby Tyler Durden, 25September2023 – https://www.zerohedge.com/geopolitical/brics-will-change-world-slowly

BRICS, the organization that is hardly noticed in the West, more than doubled its membership at the end of August – something is happening.

IntroductionIt seems to be more a rule than an exception that the most important changes in the history of financial systems either go completely unnoticed or the vast part of the public – including financial experts and investors – does not grasp the importance of such transformations.

There are several examples for this claim: On December 23, 1913 the Senate passed and President Woodrow Wilson signed the Federal Reserve Act. The FED being as “federal” as “Federal Express”, a private bank whose shareholder register is not open to the public, rules the world since 1913. The date of December 23 was wisely chosen since the public and most politicians were too engaged in Christmas preparations to realize that this event would change the order of America and then the world forever.

When Richard Nixon, on August 15, 1971, “temporarily” closed the gold window, the Sunday afternoon TV shows got interrupted – among else the TV series “Bonanza” – to inform the American people of his decision. Although, this event was called the Nixon Shock, people did not seem to grasp the importance of this deed.

Lastly, the famously brilliant Henry Kissinger managed to make a deal with King Faisal of Saudi Arabia in 1974, which gave the US unlimited financial and, therefore, geopolitical power by creating the Petrodollar, banishing the danger stemming from a U.S. dollar that was backed by nothing, by backing it with U.S. military might in exchange for nearly unlimited investments in U.S. bonds.

Now, on August 22, BRICS, an organization, which does not gather a lot of attention in the Western media, announced that, apart from the five countries, whose initials gave it its name (Brazil, Russia, India, China, South Africa), BRICS welcomed six new members (Argentina, Egypt, Ethiopia, Iran, Saudi Arabia and the United Arab Emirates) to join BRICS by January 1, 2024; therefore, BRICS becoming BRICS 11.

In this article, let us first quickly look at some facts & figures of BRICS 11. Then, we shall explore the history of the current financial system and it’s becoming in detail in order to appreciate its importance to U.S. power in the period from World War II to the present. Then we shall look at the way the U.S. abused the inherent privileges of this system, which is one reason that led to the current rise of BRICS. Finally, we shall try to answer the question whether the events of August 2023 have the potential to change the world or whether it will be one more fruitless endeavor of emerging market nations to stand-up against the Collective West. Origin of BRICSThe term BRIC was coined by Goldman Sachs economist Jim O’Neill in a 2001 paper where he explained the future economic potential of Brazil, Russia, India and China.

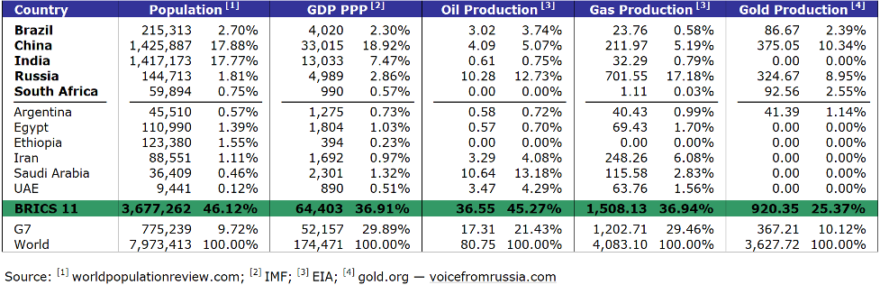

In 2006, the BRIC countries met for the first time on the fringes of the UN-General Assembly in New York. A first formal meeting took place in Yekaterinburg in 2009. The aim of this initially loose community was to improve cooperation among its members. In 2010, South Africa joined, which means that this organization has since been called BRICS. This August the number of its members more than doubled and we shall call it now BRICS 11. FiguresWith regard to the most important economic indicators such as population, GDP (PPP), oil, natural gas and gold production, naked figures show that BRICS 11 is much stronger with regard to any of these indicators than G7 (Table 1).

These figures on their own should be a wake-up call to all the people, experts, politicians and investors who still seem to believe that it is sufficient to judge the financial world from a pure western perspective.

There are a few points I would like to draw the attention to of the readers regarding the way these naked figures could and should be read and interpreted. However, I am fully aware that I can only give you a glimpse at the reality and this exercise herein is of a very limited nature indeed.